2020 Annual Market Recap

As we begin the first quarter of 2021, we are relieved to be able to put 2020 away and in the history books. Last year was one of the more challenging years we’ve experienced, both economically and marketwise, for everyone. The year began normally enough, but was rapidly impacted by concerns of a spreading global pandemic, Coronavirus. As the year continued, much of the global economic headlines indicated a grave concern and major uncertainty as to just what was going to be the ultimate consequences of this new and deadly virus. Worldwide, economies were shutting down as a function of government-mandated closures of businesses to prevent the further spread of the virus.

Throughout 2020, the world had to adapt to the new paradigm of the pandemic, and much of what occurred was a reflection of how businesses and people have adjusted. More importantly, this means that there has been a significant change to how the economies and markets of the world operate. It is our belief that what happens next will be a reflection of how the world has reacted to this pandemic and what the new adjustments are to follow.

Much of our work is tailored around evaluating the current economic climate, and in this way, we adjust our investment strategies moving forward. The pandemic has created some new economic issues and solutions, and as such, we are reviewing a wider range of aspects of the global economies. We have listed key bullet-points below to paint the picture of the current economic environment.

The U.S. & Global Economies:

- The economies and corresponding markets of the world have done a major turnaround since the lows of late March. This is due to the perception that the future impact of the pandemic will be minimized, and that global growth will resume.

- U.S. Leading Economic Index (LEI) increased .3% in December following a 0.7% increase in November. Coincident Economic Index (CEI) increased 0.3% following a 0.1% increase in November. Lagging Economic Index (LAG) increased 0.1% in December after a 0.1% increase in November. The continuing increase in all the indicators suggests further growth in the U.S. economy, and that the U.S. is in the recovery stage.

- The 2020 GDP Growth for the advanced economies of the world was down approximately -5.8% (IMF estimates). Expectations are for a significant turnaround in 2021 in GDP Growth. The following are some areas of interest for 2021:

- China 8.2%

- Japan 2.3%

- Euro Area 5.2%

- United States 3.1%

- Advanced Economies 3.9%

- China’s GDP took an initial hit due to the coronavirus back in the first quarter of last year. From the early lows, China had a solid rebound and ended the year with GDP growth at 2.3%. Current estimates for 2021 look to be 8.2% with some slowing to the 5% range over the subsequent years out 2025. China’s economy (the second largest in the world) did well because of mostly positive handling of the COVID-19 pandemic.

- The Eurozone, like the U.S., has gone through a major economic contraction. In July, the European Union (the EU) agreed to a recovery fund of 750 billion euros to mitigate the economic fallout of the coronavirus pandemic across Europe. In addition to the recovery fund, the EU said its next budget, which will fund initiatives between 2021 and 2027, will total 1.074 trillion euros. The two combined bring upcoming investments to the level of 1.824 trillion euros.

- The Fed lowered rates to effectively to zero (0.0-0.25%) back in mid-March 2020 at the onset of the pandemic. Based on continuing statements from the Fed, there is little expectation of any increase for several years.

- Congress passed a $2.2 trillion economic stimulus bill known as the CARES Act, which was passed by the 116th U.S. Congress and signed into law by President in March 2020. Further legislation is now being debated to provide continuing economic stimulus which expected to be approximately $1.9 trillion.

- Global inflation is expected to remain very low for the next several years. Inflation in the U.S is currently at 1.4% and is expected to increase only incrementally over the next several years. Global inflation rates are low with the advanced economies ending 2020 at less than 1.0% and are expected to remain less than 2% over the next several years.

- U.S. unemployment rose to over 14.8% around April 2020 as businesses were shut down due to the government mandated closures. Subsequently, unemployment has recovered as businesses adapted and is now at 6.3%. Expectations are for rates to decline to the lower 4% range over the next several years.

- Globally, unemployment rates have fallen from the initial highs at the inception of the pandemic. Most advanced economies of the world are expecting unemployment to trend lower over the next few years to an approximate range of 5% to 6% (Source: IMF).

- Oil prices (WTI) had fallen to a little over $12 per barrel (spot price) in late April reflecting the reduction in demand and oil supply conflict between Saudi Arabia and Russia. Tensions subsequently eased, production has been reduced, and demand has been rising. As such, oil prices have rebounded dramatically to a current price of $56.85 per barrel.

- 2020 was a presidential election year in the U.S., and Joe Biden, a Democrat, was elected as the new U.S president. The House of Representatives continued with a Democrat majority, while the Senate ended up with a 50 – 50 split by party with the Vice-President, Kamala Harris, (the deciding vote in event of a tie) shifting the majority to Democrats. As it stands now, we have both the Executive and Legislative branches (Senate & House) controlled by the Democratic Party.

The U.S. & Global Stock and Bond Markets

Equities

- Large-Cap U.S. stock did very well after the decline in the first quarter as the economy reacted to the Fed low interest rates and legislation injecting stimulus into the economy. The Large-cap stocks did well with the S&P 500 moving up 18.4%.

- The current consensus estimates for S&P 500 earnings & P/E ratios:

- 2020 earnings estimate $138.71: P/E 27.6 (Compared to 2019 actual earnings of $162.67)

- 2021 future earnings estimate $171.55: P/E 22.4

- 2022 future earnings estimate $198.52: P/E 19.3

- U.S. small-cap stocks (Russell 2000) excelled in 2020 with a 20.0% return.

- European stocks (MSCI Europe) were up 5.4% in 2020 as Europe was slow to recover from the initial stages of the pandemic. Although the pandemic has impacted Europe, they have instituted a stimulus plan and their economies seem to be recovering, as evidenced by a 15.6% gain in the fourth quarter of 2020. The European Union stimulus package was implemented in July.

- China was a global winner of the major economies with a 29.7% gain (MSCI China Index). The major gains had much to do with China’s handling of the pandemic and a resurgence in their economy.

- The sector winners in 2020 were technology & precious metals.

- Technology (Dow Jones US Technology) stocks turned in a stellar performance in the second quarter with a 47.3% gain.

- Precious Metals (XAU – Gold Mining Index) turned in a stellar performance with a gain of 34.9% in 2020.

- Oil Stocks (XOI – Oil Stocks Index) declined dramatically in the first quarter reflecting the collapse in global demand as well as the conflict between Saudi Arabia and Russia. Prices have since rebounded 59.7% from the March 23rd lows.

Fixed Income & Cash

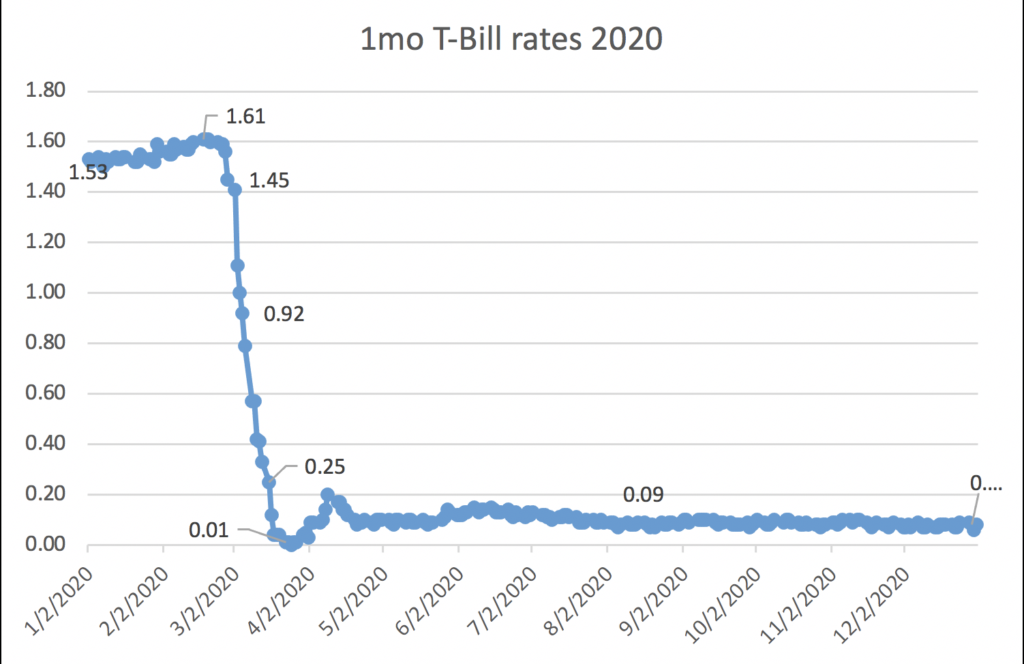

Interest rates declined dramatically in 2020 in response to the Fed’s accommodative stance. In February T-Bill rates were around 1.6% and then plummeted to almost a zero-percentage rate as concerns about the Coronavirus pandemic became clearer. Yields were continuing to drop and by April, yields had dropped to close to zero. (SEE CHART BELOW) As a consequence, most money market fund yields have dropped to almost zero.

- Long-term bonds did very well as the Fed injected monies into all segments of the bond market. With Fed policy pushing rates downs, long-term rates declined, resulting in gains to bonds. The long bonds (ICE U.S. Treasury +20 Year Bond) returned 18.1% over 2020.

The FPC Team’s Insights & Perspective:

- At the beginning of 2020, the U.S. stock market had a short-lived and significant decline, followed by an equally significant increase to eventually reach new all-time highs.

- With both fiscal and monetary policy on board in the U.S. and throughout the world, equities have the most opportunity of the broader asset categories. Bonds yields moving lower has reduced their appreciation potential, while cash yields have lowered to almost zero percentage.

- The global markets are awash of vast amounts of liquidity as the Central banks have lowered interest rates, and governments are providing stimulus to pick up their economies.

- We are beginning a new year, 2021, with the promise of several vaccines that have a fairly high effectiveness rate. As of present, there are more than 40+ million Americans who have received the vaccine, and more than 138 million shots have been distributed globally.

The FPC Outlook

So, what is our view of the future? The economies have improved dramatically since the re-openings of businesses, and unemployment has dropped from its previous highs. There is a tremendous (one could say extraordinary) amount of both fiscal and monetary stimulus that has been injected into the economies of the world. The market(s) have seen a dramatic rise from the March 23rd low. Since then, the S&P 500 has jumped 75.0% to present (Feb. 09) 2021.

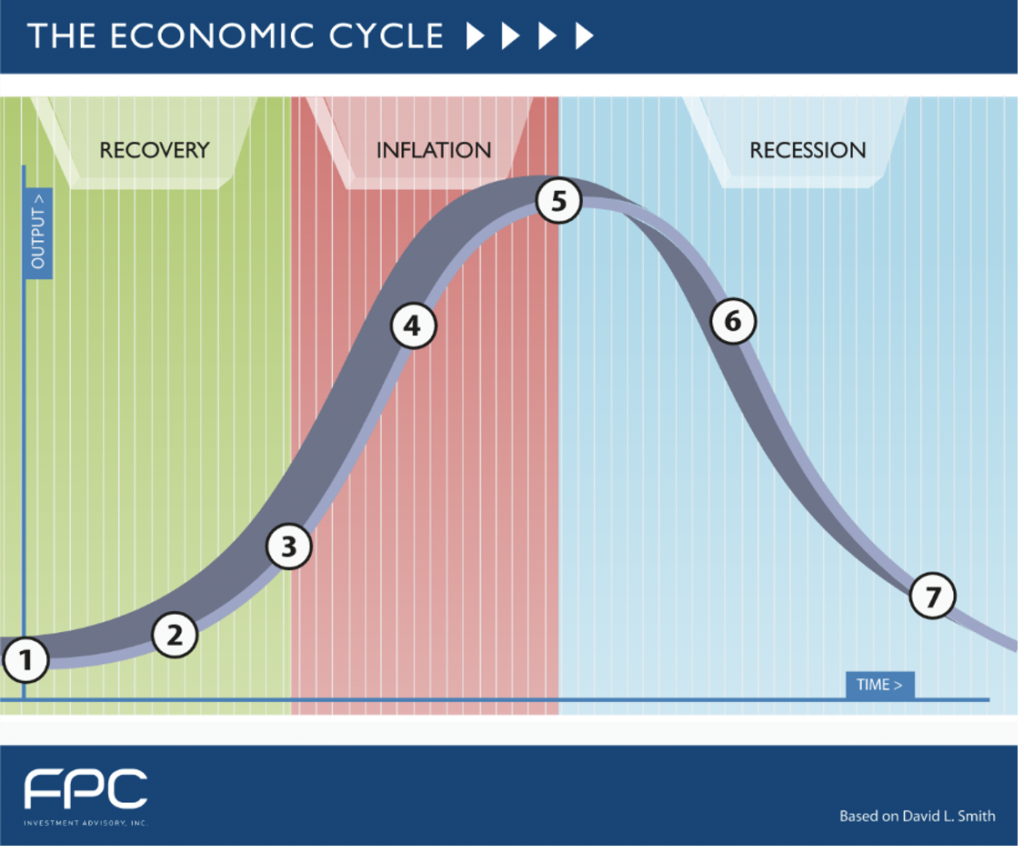

It is our belief that for the near-term future, the key indicator for the global economies will be the overall handling of the COVID-19 pandemic. As people feel free to go about their daily lives, the economies of the world should see significant improvements. The economic impact is that, for the most part, the global economies are in a recovery phase (Waypoint 2) which bodes well for the stock market looking forward.

The Economic Cycle

Against that backdrop, domestic market valuations are clearly on the expensive side. Alternatively, international valuations are more attractive than domestic markets as their economies have been slow to react to the economic consequences of the pandemic. As such, we have shifted some of the U.S. allocations to the Eurozone and Asian asset classes. Earlier in the year, we made a slight reduction to our overall equity allocation. Ultimately, at this point in the economic cycle, equities are the best opportunity looking forward.

We greatly appreciate the confidence you have shown in our services. Thank you for your business!

Sincerely,

Blair McCarthy & Bijan Golkar, CFP®