2022 First Quarter – 12 Month Recap

It has been two years since the pandemic began in March of 2020. During that time, vast amounts of stimulus, both monetary and fiscal, were injected into the global economies. As we ended 2021, the world economies started to look past the worst parts of the pandemic. Notwithstanding, the stimulus that provided vast amounts of relief also had some consequences.

Today, the world is feeling these consequences with elevated inflation, supply chain chaos, and slow (but still positive) global growth. Additionally, the Russian invasion of Ukraine has exacerbated inflationary and supply chain issues.

Below you will find some key points on our current economic landscape.

The U.S. & Global Economies:

- U.S. Leading Economic Index (LEI) increased 0.3% in March following a 0.6% increase in February. The Coincident Economic Index (CEI) was up 0.4% in March following a 0.4% increase in February. The Lagging Economic Index (LAG) increased 0.6% in March after a 0.2% increase in February. The recent increase in all three of the Economic Indices point to continued, but moderate, economic growth in the near term.

- March’s unemployment was 3.6% which was slightly improved from February’s 3.8% rate. In a report from the Bureau of Labor Statistics, the number of job openings was nearly twice the number of job applicants. This represents the largest amount of job openings since the year 2000.

- In the fourth quarter, the U.S. economy turned in a robust 6.9% annualized GDP growth rate. Since then, the U.S. economy’s growth rate slowed to pre-pandemic levels in the first quarter of 2022. The Philadelphia Fed, in a Survey of Professional Forecasters, projects real GDP growth grew at an annualized rate of 1.8% in the first quarter.

- China’s growth for the last twelve months beat expectations, turning in a GDP growth rate of 4.8% on a year-over-year basis. Notwithstanding the solid growth, the data also indicated challenges to the second-largest world economy. China is still aggressively pursuing a zero-tolerance policy on COVID-19, which continues to cause issues to the global supply chain.

- European GDP is continuing to expand with some modest inflation. Europe had a more benign approach to stimulus which has thus far prevented the extreme inflation the US is seeing. Consumer consumption continued with a high level of pent-up demand for goods and services. GDP growth is forecasted to be 4.2% in 2022, and 2.2% in 2023.

- Japan, the fourth-largest economy in the world, is projected to have grown a meager 0.6% in first quarter of 2022. Japan is expected to continue in a slow, almost stagnation-level of GDP growth through 2023, forecasted to be 1.3%.

- The Fed has taken the position that there is a need to raise the Fed Funds rate to a neutral level (between 2.5-3.5%). Recently, Federal Chairman Jerome Powell indicated that the central bank will likely raise the Fed Funds rate by 0.5% in their May meeting. This would mark the first time in 22 years that the Fed will raise rates by more than 0.25%.

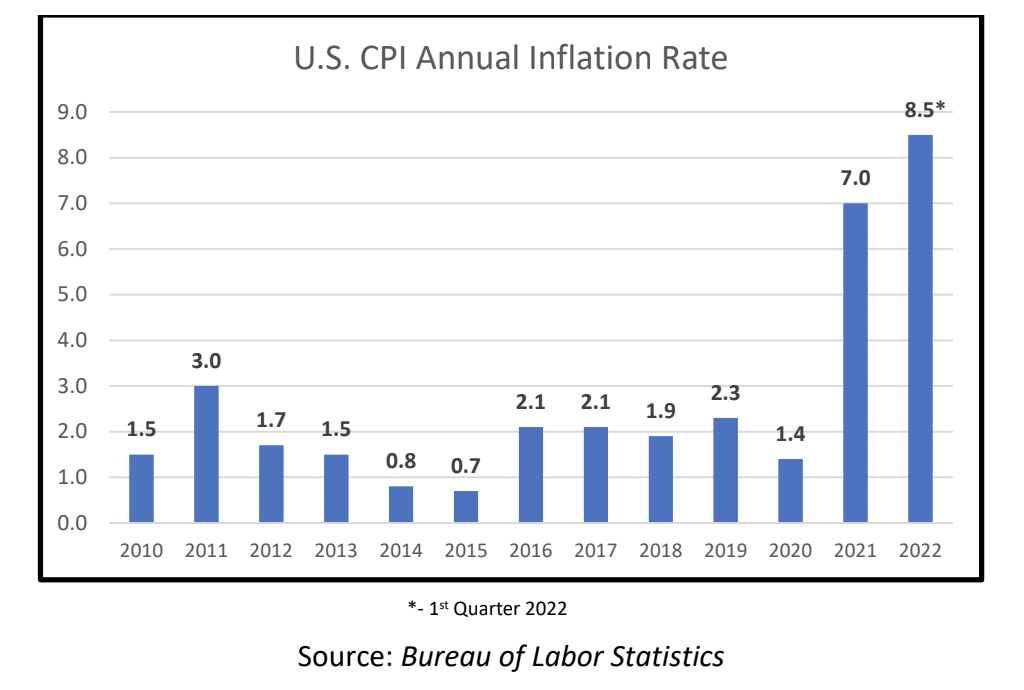

- Inflation increased in the U.S. to 8.5% for the period ending in March. This being the highest level since December 1981, a period of over 40 years (See Annual Inflation Chart below). Much of the inflation is a result of supply chain issues and significant demand from consumers. Prices are rising throughout the economy; food costs have seen double-digit increases and gasoline prices have doubled.

- Oil prices continue to climb from the pandemic lows when prices (WTI – West Texas Intermediate) fell to around $12 a barrel. Since then, prices have rebounded dramatically, and are currently above $99 a barrel.

- The number of Americans applying for unemployment has fallen below 200,000, further evidence that the job market continues to be strong. The latest unemployment rate is now at 3.6% (as of Mar. 2022). The IMF forecasts the U.S. unemployment rate to trend lower over the next few years to approximately 3.0%.

The U.S. & Global Equity and Bond Markets

Equities

- Equities in the first quarter of 2022 pulled back modestly, over concerns with supply-chain issues, inflation levels, and the Fed increasing interest rates. Large-cap stocks (as measured by the S&P 500 Index) lost -4.6% in the first quarter while showing a gain of 15.7% over the last twelve months (ending March 31st). Across the globe, the developed markets managed to turn in positive results with the MSCI All Countries World Index (ACWI) moving up 7.3% for the last twelve months (ending Mar. 31, 2022), while declining in the first quarter with a -5.4% return.

- U.S. small-cap stocks (Russell 2000) fell -5.8% over the last twelve months (ending Mar. 31, 2022) and were down -7.5% in the first quarter of 2022.

- Historical and current consensus estimates for the S&P 500 earnings & price-to-earnings ratios (P/E):

- 2019 actual earnings $162.97: P/E 19.8 (S&P 500 year-end value at 3,230.78)

- 2020 actual earnings $139.76: P/E 26.9 (S&P 500 year-end value at 3,756.07)

- 2021 actual earnings $208.53: P/E 22.9 (S&P 500 year-end value at 4,766.18)

- 2022 future earnings estimate $227.42: P/E 19.3 (S&P 500 current value 4,391.69)

- 2023 future earnings estimate $249.88: P/E 17.6 (S&P 500 current value 4,391.69)

- European stocks (MSCI Europe) were off -7.2% over the last twelve months (ending March 31st), its worst performance in two years over the concerns of lack of growth, inflation, and the Russian-Ukraine conflict.

- Japanese stocks were down -6.1% (MSCI Japan Index) for the last twelve months (ending March 31st) as their economy was challenged by supply-chain issues along with concerns of the Russian-Ukraine conflict.

- China (MSCI China Index) turned in negative results with a -32.5% loss for the year (ending March 31st). China’s zero-tolerance policy on COVID-19 has created a fresh set of lockdowns for residents and businesses. These lockdowns are slowing growth and, in some cases, causing businesses to shut down operations.

- Technology (MSCI World Information Technology) stocks turned in solid performance with a 15.1% gain over the last year (ending March 31st). Notwithstanding, the index declined -10.2% in the first quarter.

- Precious Metals (MSCI ACWI IMI Precious Metals and Minerals Index) declined -9.4% over the last twelve months (ending March 31st). Notwithstanding, the index was up 6.4% in the first quarter as inflation pushed precious metals up.

- Energy stocks (MSCI USA Energy Index) turned in exceptional results with a 60.7% return over the last twelve months (ending March 31st) and were up 38.3% for the first quarter. Energy stocks were the clear winner over the last year and the first quarter of 2022. Commodities have made dramatic increases due to supply-chain problems and demand issues.

Bonds & Cash

- Short-term Interest rates began to move higher in the first quarter as the Fed raised rates. Short-term bonds (ICE U.S. Treasury Short Bond Index) were mostly breakeven with a 0.1% return for the last twelve months (ending March 31st). (See Treasury Interest Rates chart below)

Source: U.S. Department of the Treasury

- Longer-term bonds (ICE U.S. Treasury 20+year Bond) were essentially flat with a decline of -0.6% over the last twelve months (ending March 31st). This index turned in a significant drop of -10.8% in the first quarter as interest rates moved higher reflecting the Fed’s push to stave off inflation.

FPC Team’s Insights & Perspective:

The U.S. and global markets have been awash in vast amounts of liquidity as the central banks kept interest rates low and governments provided fiscal stimulus to their economies. Moving forward, these accommodative policies are being reversed to a more neutral level. As such, savers will be rewarded with improved yields, while buyers will now be subject to higher interest rates.

In light of the rising interest rate environment, it will be difficult for bonds to produce substantive returns, especially in the longer maturity bonds. On the flip side, money market funds should begin to see an increase in yield. The 13-week T-bills are currently yielding 0.82%, a major increase in the overall yield.

FPC’s Outlook

Domestic economic issues remain largely unchanged and include the COVID-19 pandemic, supply-chain issues, high inflation, and a major conflict between Russia and Ukraine. Consumers and businesses are challenged on how best to cope in this complex environment. Our current view is that most of the global economies are in the mid-stages of an economic recovery. The stimulus during the pandemic, both fiscal and monetary, is the primary cause for the current inflation levels and will require Fed-induced higher interest rates. Global growth is slowing, but not yet contracting. The central banks are now faced with a balancing act of reducing inflation without causing a recession.

Notwithstanding, we have experienced a market correction which was needed to pull some of the over-valuation off the markets to a more reasonable level. The current market pullback (which began on January 3rd, 2022) has lowered valuations to historically normal levels. The U.S. remains somewhere between waypoint 3 and 4; while there is still ongoing growth, inflation is now a cause of concern. More importantly, the Fed will take proactive measures to reduce it to more benign levels. (See the Economic Cycle chart below)

The Economic Cycle