Economic & Market Commentary Q1 2024

2024 began with debates over a “soft” versus “hard” landing as the Fed attempted to stabilize the economy, as well as over the sustainability of last year’s market rally. Only three months later, those concerns have given way to a calmer environment centered around fading inflation and the Fed’s plans for reducing interest rates. This has resulted in a strong market rally with the S&P 500 index, Dow Jones Industrial Average, and Nasdaq gaining 10.2%, 5.6%, and 9.1% year-to-date, respectively (as of 03/31/2024).

The economic environment has surprised many investors as inflation continues to fade. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures index, rose 2.5% on a year-over-year basis for all prices and 2.8% when excluding food and energy, both significant improvements from their peaks only a year and a half ago. While some areas of inflation such as shelter and energy costs remain problematic, inflation is slowly returning to the Fed’s long-term 2% target.

As of the end of the first quarter, the unemployment rate remained below 4% even amidst layoffs in the technology sector. Interest rates were stable during this period, with the 10-year Treasury yield holding at approximately 4.2%. Moreover, stock market returns have diversified beyond merely artificial intelligence stocks. Despite these positive trends, some investors are concerned about the upcoming presidential election and the next phase of Fed policy. These worries, along with increasing geopolitical risks, are only amplified by the fact that the market is hovering near all-time highs.

In uncertain market environments, it’s more important than ever for investors to maintain a long-term perspective. Below are five key insights for understanding upcoming events and how they affect investors.

1. Steady Economic Growth Has Driven Markets to New All-Time Highs

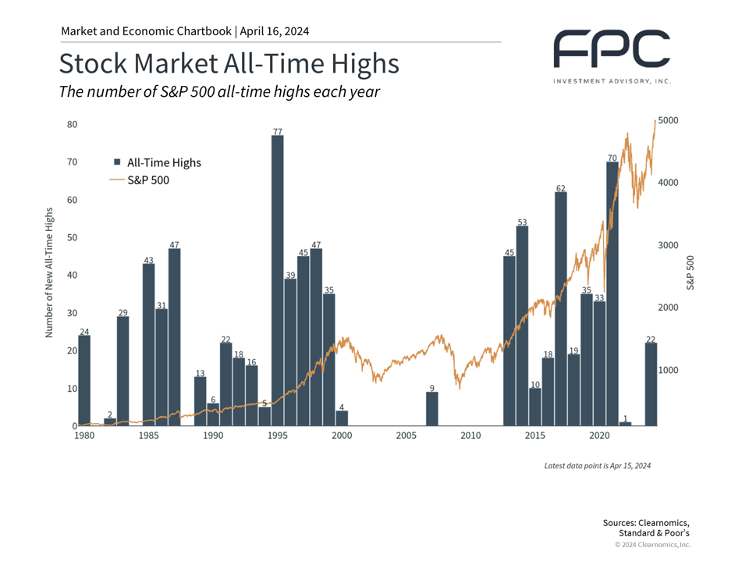

The S&P 500 has achieved 20 new all-time highs so far this year despite the brief market pullback during the first two weeks of the year. While this is positive for investors, it is easy to worry that continued market growth may not be sustainable. Do new all-time highs mean that the market is due for a pullback?

While price swings are an unavoidable part of investing, and the market does experience pullbacks from time to time, history shows that markets also tend to rise over long periods. During a bull market cycle, major stock market indices will naturally spend a significant amount of time near record levels, as shown in the accompanying chart. For instance, 2021 experienced 70 days with the market closing at new all-time highs, adding to the hundreds achieved since 2013.

Taking a long-term perspective allows investors to benefit from these market trends without constantly worrying about when a pullback might occur. Holding an appropriately diversified portfolio can help investors withstand market pullbacks without focusing too much on the exact level of the market.

2. Markets Have Rallied Through Both Democratic and Republican Presidencies

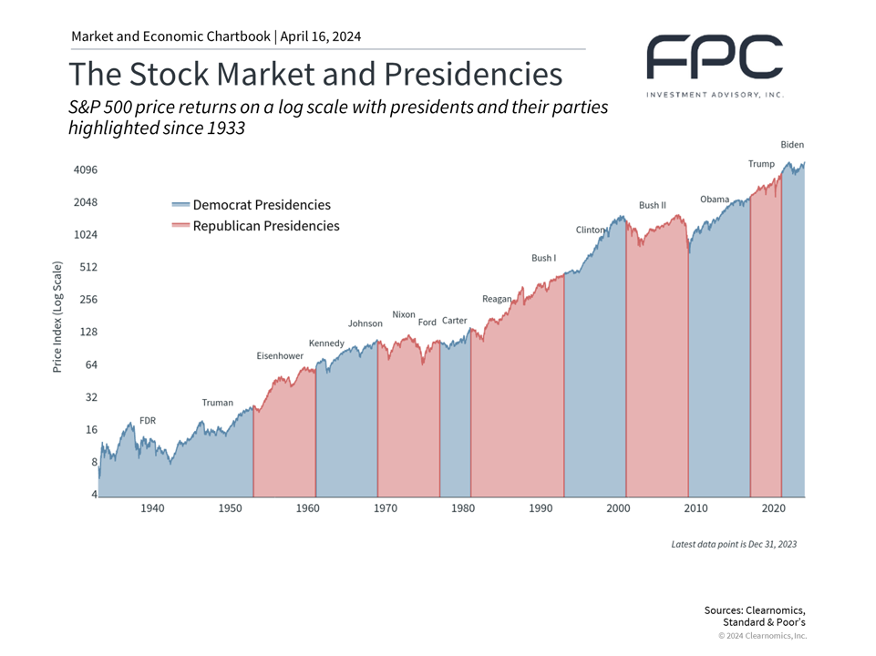

Coverage of the presidential election is heating up ahead of the November rematch between Presidents Biden and Trump. While elections are an important way for Americans to help shape the direction of the country as citizens, voters, and taxpayers, it’s important to vote at the ballot box and not with investment portfolios.

This is because history shows that markets can perform well under both Democrats and Republicans. As the accompanying chart shows, the economy and stock market have grown over decades regardless of who was in the White House. What mattered more across these periods were the ups and downs of the business cycle. The Clinton years, for instance, benefited greatly from the long expansion of the 1990s. The George W. Bush years, on the other hand, overlapped with both the dot-com crash and the 2008 global financial crisis. Business and market cycles defined their presidencies and not the other way around.

Of course, politics can impact taxes, trade, industrial activity, regulations, and more. However, not only do these policy changes tend to be incremental, but also the exact timing and effects are often overestimated. Thus, it’s important to focus less on day-to-day election poll results and more on the long-term economic and market trends. Ideally, investors concerned about the impact of specific policies on their financial plans should speak with a trusted financial advisor.

3. The Fed Is Expected to Cut Rates as Inflation Stabilizes

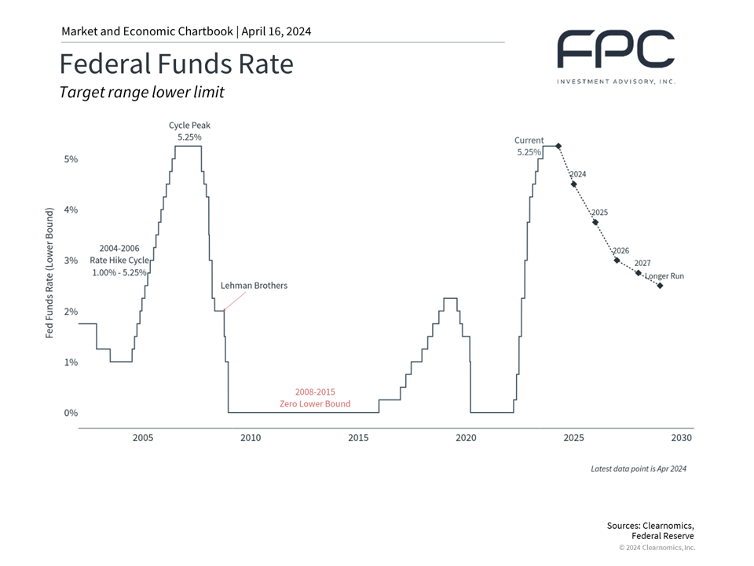

The market rally broadened beyond mega-cap technology stocks in the first quarter. The equal-weight S&P 500, an alternative to the standard market cap-weighted index, hit a new all-time high in early March, indicating that a wider range of stocks is performing well. The positive economic outlook and the possibility of rate cuts have boosted optimism across many parts of the market.

Given this backdrop, the Fed is expected to cut rates later this year, although the timing remains uncertain. The accompanying chart shows the possible path of the federal funds rate based on the Fed’s latest projections, including three cuts this year. At its last meeting, the Fed cited strong job gains and low unemployment as indicators of solid economic activity but emphasized that “the Committee does not expect it will be appropriate to reduce [interest rates] until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Regardless of the exact timing and path of Fed rate cuts, these projections represent a reversal of the emergency monetary policy actions that began in early 2022. For investors, it’s important to adapt to this changing environment and not focus solely on the events of the past few years.

4. Rising Geopolitical Tensions Add to Market Uncertainty

Tensions have escalated in the Middle East due to an attack by Iran on Israel, the first time a direct strike has occurred between the two nations. While it’s uncertain how Israel might respond to this shot across its bow, many hope that both nations will show restraint and avoid an overt conflict.

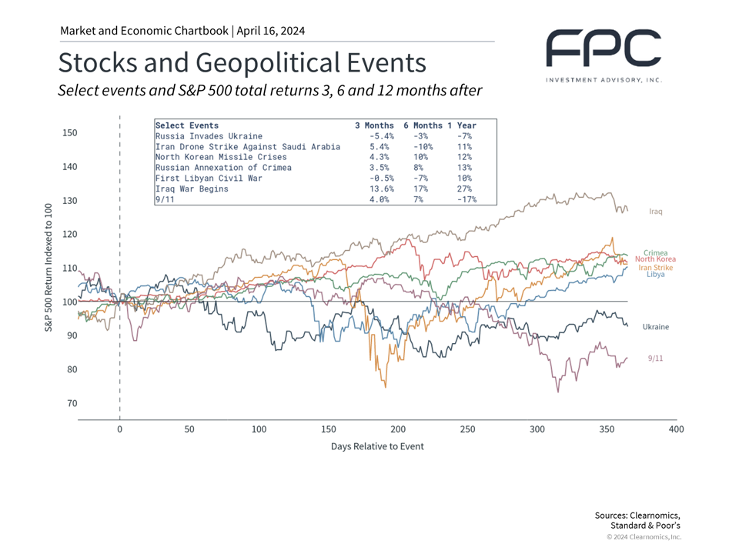

These latest developments only add to geopolitical concerns around the world. Russia’s invasion of Ukraine and the October 7 attack on Israel by Hamas only a year and a half later have already destabilized Eastern Europe and the Middle East. Without diminishing the tragic loss of life and destruction from these conflicts, investors must weigh how such events might impact the global economy, markets, and their portfolios.

Geopolitical headlines can be alarming to investors since they are unlike the typical flow of business and market news. These events are difficult to analyze, and their outcomes are challenging to predict since they depend on the actions of individuals and groups with complex histories and motivations.

However, history shows that while geopolitics can impact markets, the effects are typically short-lived. The accompanying chart highlights market returns following major geopolitical events this century. Some events, such as 9/11, changed the world order and had long-lasting effects, even though it was primarily the dot-com bust that led to poor market performance. Other events, such as the war in Ukraine, resulted in higher oil prices which affected inflation and monetary policy. Most of these events did not have long-lasting effects on markets once the situation stabilized.

While today’s conflicts will be closely watched, investors should avoid passing judgment with their portfolios. In the long run, markets tend to recover and perform well primarily because business cycles are what matter over years and decades, despite the events that take place over weeks and months.

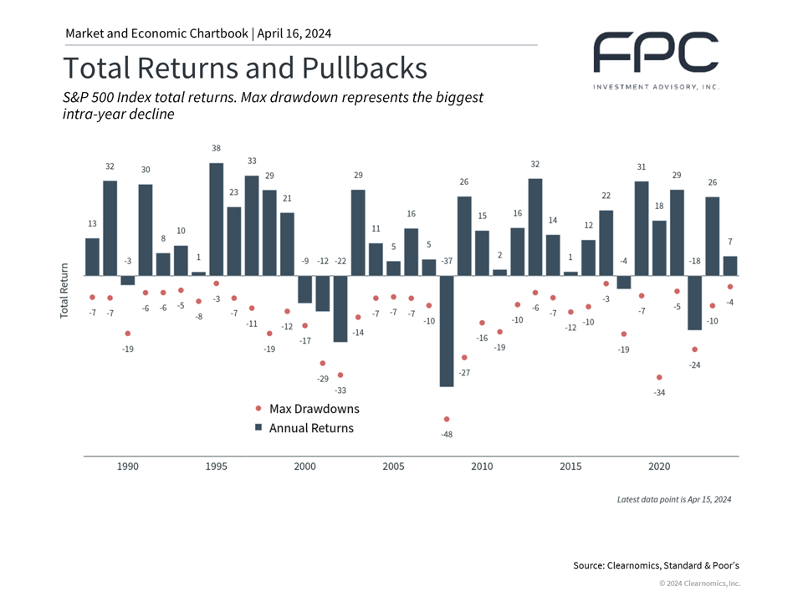

5. Investors Should Always Be Prepared for Market Volatility

Finally, investors should also keep the level of market volatility in perspective. While the recent 4% market decline is the largest since the start of the year, this follows a 10.6% total return in the first quarter. The accompanying chart shows that the average year experiences significant pullbacks and that this year’s has been small by comparison. Despite these short-term challenges, markets tend to recover and often end on positive notes. This is why maintaining a diversified portfolio can help minimize short-term risk and increase the odds of financial success over time, regardless of whether markets are volatile due to the economy, the Fed, geopolitics, or other factors.

The bottom line? Despite market struggles at the start of the second quarter due to shifting Fed expectations and rising geopolitical tensions, maintaining composure and keeping a broader perspective on these events remain paramount for achieving long-term financial goals. Moreover, with markets hovering near all-time highs, an impending presidential election, and anticipated Fed rate cuts later in the year, adhering to financial plans and staying invested through the second quarter remains the optimal strategy. History demonstrates its efficacy in achieving long-term financial objectives. Additionally, given the current position in the economic and business cycle, we are positioned slightly cautiously, ensuring we are well-prepared to navigate any upcoming uncertainties while seeking to capitalize on potential opportunities.