Staying the Course in a Volatile Environment

“Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.” – Peter Lynch.

If the start of 2025 has left you feeling like the ground is shifting beneath your feet, you’re not alone. The first quarter of the year — and particularly the volatility we experienced in April — has tested investor discipline. Inflation data surprised markets, expectations for rate cuts shifted, and geopolitical uncertainty resurfaced.

These moments challenge even the most seasoned investors. But time and again, markets have shown their ability to recover, adapt, and grow. That’s why we continue to emphasize what has always worked: maintaining a long-term perspective and sticking with a well-constructed portfolio (Check out our recent video – Why Your Portfolio Is Built for Moments Like This).

What Happened in Q1?

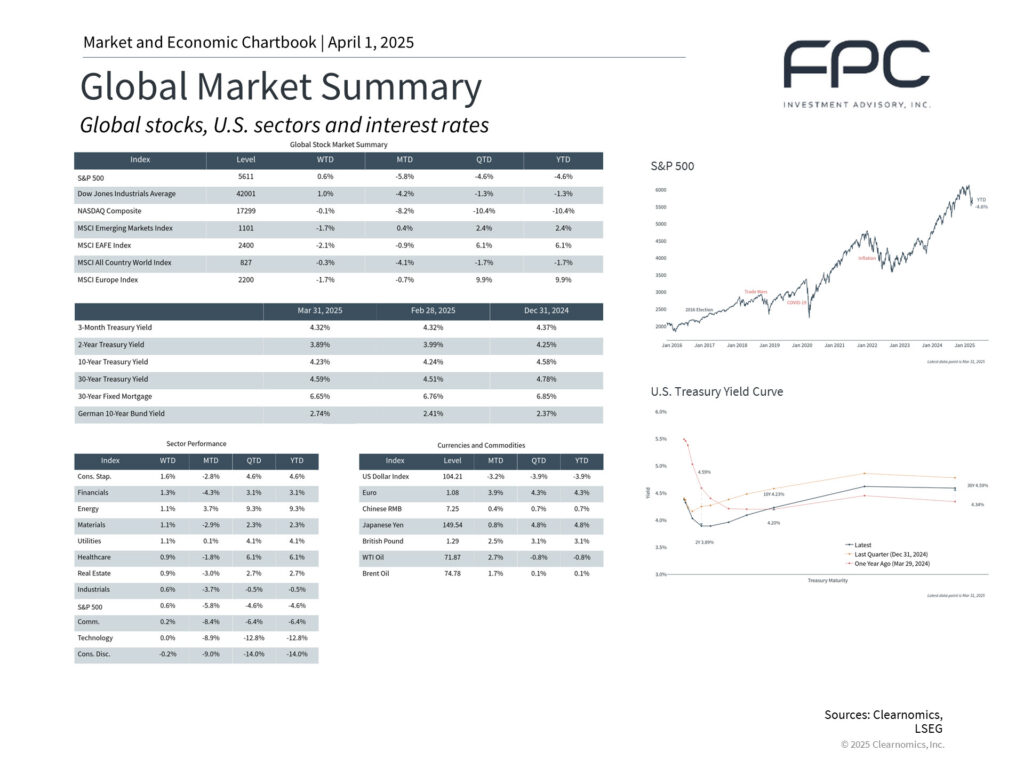

The first quarter ended with modest declines in U.S. stocks:

- S&P 500: –4.6%

- Nasdaq: –10.4%

- Dow Jones Industrial Average: –1.3%

However, other areas of a diversified portfolio provided stability:

- Bloomberg U.S. Aggregate Bond Index: 2.8%

- MSCI EAFE (Developed International Stocks): 6.1%

- MSCI Europe Index: 9.9%

- Gold: Reached a record high above $3,100/oz

- 10-Year Treasury Yield: Fell to 4.2% after peaking near 4.8% in January

While headline inflation (CPI) increased by 2.8% and core inflation by 3.1%, both remain above the Fed’s target. Against this backdrop, corporate earnings growth is expected to slow to a range of 6% to 9% in 2025, reflecting a more measured but still healthy corporate environment.

April’s Rollercoaster: What Changed

After Q1 wrapped up, volatility returned in full force:

- Inflation surprised to the upside, especially in services, putting pressure on the Federal Reserve to hold off on rate cuts.

- Markets recalibrated expectations, shifting from three projected rate cuts to possibly just one or two in 2025.

- Geopolitical tensions and trade disputes re-emerged, rattling investor confidence.

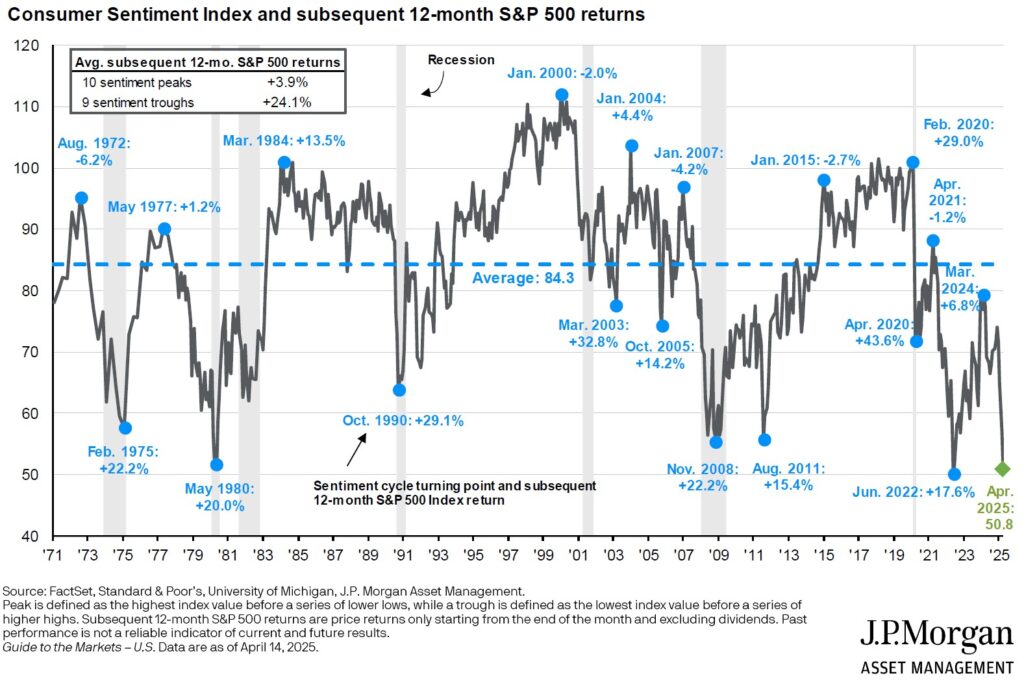

- Consumer sentiment fell sharply, with the University of Michigan index dropping below 51, the lowest since 2022. Low point milestones in this index generally provide attractive subsequent 12-month returns (see chart below).

Despite the headlines, volatility is not the enemy but a natural part of the investing journey.

Perspective: Why Long-Term Discipline Matters

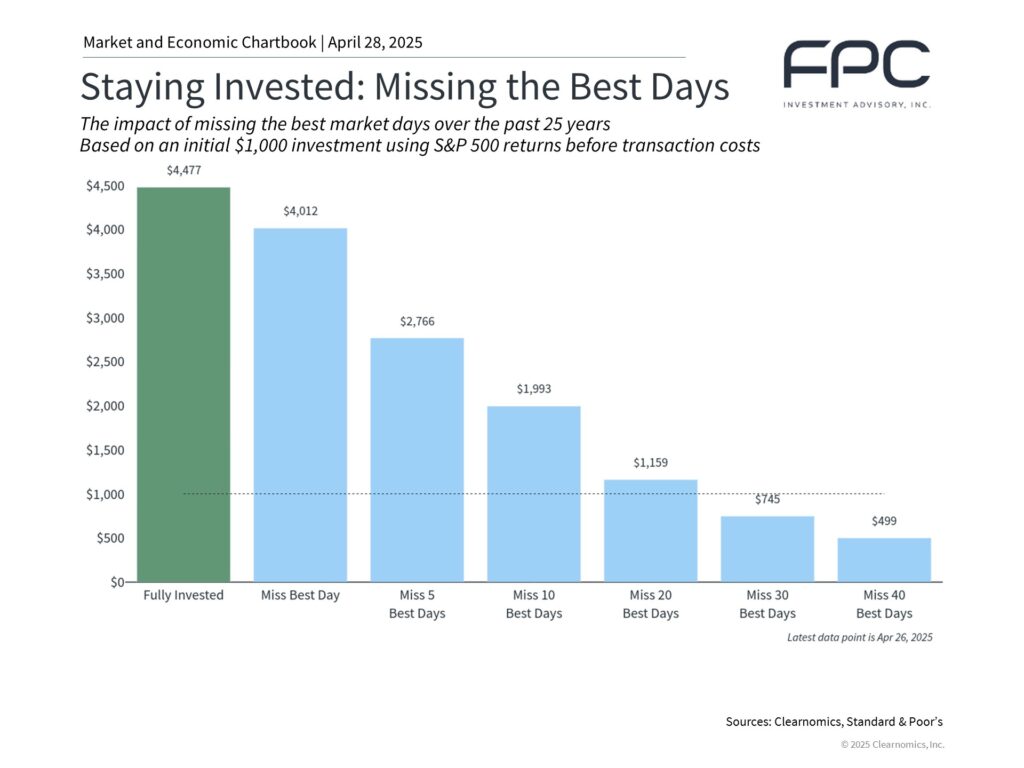

When markets become volatile, it can feel like this time is different. But history teaches us that every crisis, correction, and recession has ultimately been followed by recovery:

- 1987 crash

- 2000s tech bubble burst

- 2008 financial crisis

- 2020 pandemic shutdown

Each one felt like a unique threat to the market’s foundation. In each case, those who stayed invested were eventually rewarded. Those who tried to time their way around uncertainty often missed the rebounds (see chart below).

The Power of Balance and Diversification

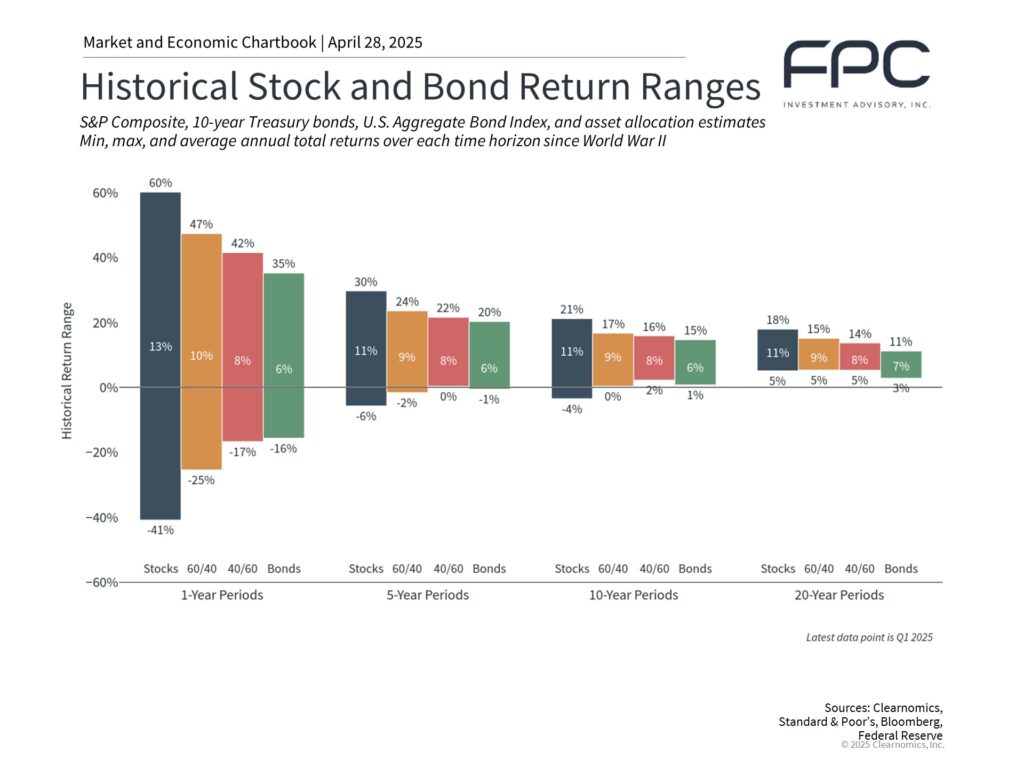

We do not build portfolios based on headlines at FPC — we construct them to withstand them. We prioritize creating portfolios that are diversified, balanced, and designed for the long term, helping you navigate short-term noise and stay focused on lasting results. The chart below shows historical return ranges across 1, 5, 10, and 20-year periods for stocks, bonds, and balanced portfolios (like a 60/40 mix).

Insights:

- Over 1-year periods, stocks have ranged from +60% to –41%, while 60/40 portfolios ranged from +47% to –25%

- Over 20-year periods, stock returns narrowed to +5% to +18%

- A 60/40 portfolio over 20 years had a similar return range: +5% to +15%

Takeaway: Over time, a diversified portfolio has delivered returns comparable to stocks — but with significantly less volatility. That smoother experience helps investors stay disciplined, avoid emotional decisions, and ultimately reach their goals.

Looking Forward

We are closely monitoring inflation trends, interest rate developments, and trade policy negotiations, all of which will continue to shape the economic landscape. The Federal Reserve is maintaining a cautious stance, forecasting just 1.7% GDP growth for 2025 — a slower pace than in recent years, but one that still reflects underlying resilience in the economy. Although headline risks may continue to capture attention and introduce volatility, these fluctuations reinforce the importance of staying anchored to a disciplined investment strategy. Your portfolio is purposefully constructed to look beyond the noise and focus on what truly drives success over time: balance, diversification, and a commitment to long-term outcomes.

Thank you, as always, for your trust and partnership.