As we move into the final quarter of 2025, investors are once again being pulled in two directions. On one side, markets continue to hit record highs, supported by resilient corporate earnings, enthusiasm around artificial intelligence, and signs that inflation is largely under control. On the other side, the labor market has softened, prompting the Federal Reserve to cut rates and raising questions about the true strength of the economy.

If that sounds contradictory, it is. The economy rarely moves in a straight line, and the market rarely behaves the way headlines suggest it should. Instead of reacting to short-term noise, investors are better served by focusing on what they can control: asset allocation, time in the market, and staying aligned with their long-term plan.

Market Overview: Q3 2025 in Review

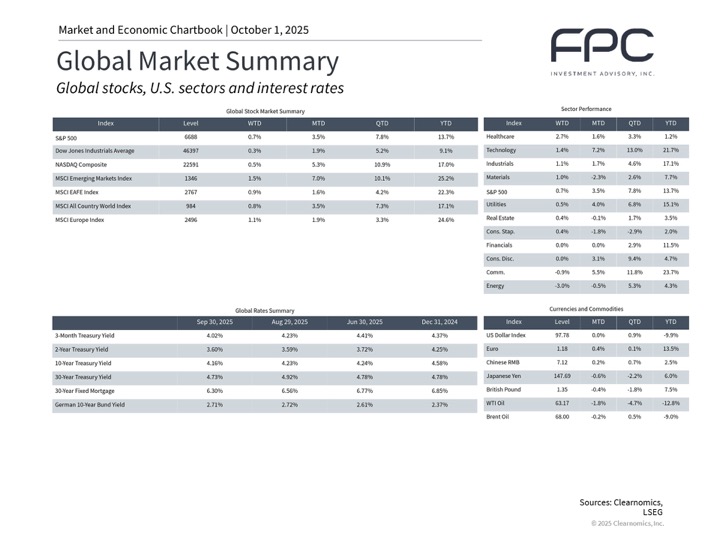

The S&P 500, Nasdaq, and Dow Jones Industrial Average gained 7.8%, 10.9%, and 5.2% respectively, in the third quarter, each setting new record highs in September. Year to date, they are up 13.7%, 17.0%, and 9.1%.

Bonds also contributed, with the Bloomberg U.S. Aggregate Bond Index rising 2.0% in Q3 and 6.1% for the year. The 10-year Treasury yield ended the quarter at 4.16% after falling as low as 4.02% in September.

Internationally, developed markets rose 4.2%, while emerging markets climbed 10.1% in the quarter. Gold reached an all-time high of $3,841 per ounce, up 16% for the quarter.

The U.S. Dollar Index fell to a low of 96.63 in September before ending at 97.78 for the quarter. So far this year, the dollar has declined 9.9%. The Consumer Price Index increased 2.9% in August, while core CPI rose 3.1%. The only soft spot has been labor. August saw only 22,000 new payrolls added, well below the average of 123,000 from earlier in the year. Even more striking are the payroll revisions, suggesting that 911,000 fewer jobs were created over the twelve months through March than originally reported.

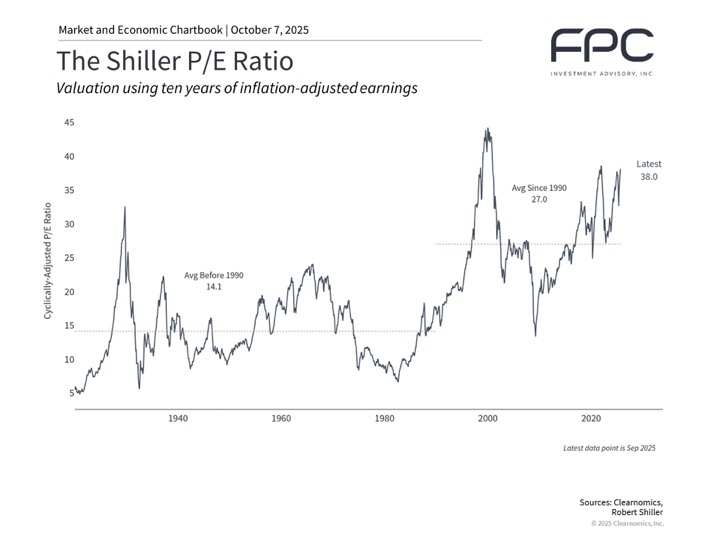

Valuations Remain Elevated

Valuations continue to trend toward historic highs. While that can make investors uneasy, high valuations alone don’t cause markets to decline. Price movement is ultimately driven by earnings, sentiment, and liquidity.

The Fed’s recent rate cuts should be viewed as policy normalization after several years of tightening, rather than an emergency response. Growth has slowed, but it remains positive. Historically, this type of environment — moderate growth and easing policy — tends to support mid-cycle resilience rather than recession.

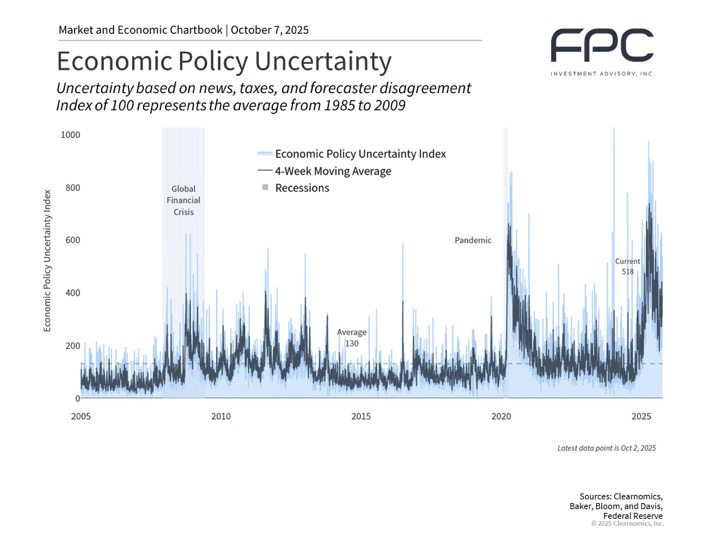

Policy Uncertainty and Volatility Are Cooling Off

Despite all the noise, measures of market and policy uncertainty have actually improved. The VIX index of stock volatility sits near 16, below its long-term average, while the MOVE index of bond volatility has fallen below its historical mean.

Bull markets often climb a “wall of worry.” Over the past several years, investors have faced inflation spikes, rate hikes, trade disputes, and geopolitical events, yet those who stayed invested were rewarded.

Volatility itself is not the problem. Reacting to it is.

The Takeaway

This year’s rally has left many investors feeling uneasy. Stocks are hitting all-time highs even as the data looks mixed and the Fed is easing. That tension often sparks the urge to take action.

As philosopher Carveth Read first wrote over a century ago, “It is better to be roughly right than precisely wrong.” The line was later echoed by John Maynard Keynes and often repeated by Warren Buffett, each using it to remind investors that success comes from sound reasoning and patience, not perfect precision.

The advantage in investing does not come from guessing what happens next. It comes from staying disciplined, keeping perspective, and letting time do the compounding.

As we close out 2025, remember that the market does not reward those who react. It rewards those who remain consistent.