Markets Reach New Highs Amid Global Tensions and Historic Tax Reform

The second quarter of 2025 was a case study in market resilience. Despite early volatility from new tariff announcements and armed conflict between Israel and Iran, investors largely looked through the noise as a ceasefire and improving trade talks quickly boosted sentiment. The result was one of the fastest rebounds on record, driving stocks to new all-time highs. Meanwhile, Washington delivered significant new tax legislation, providing investors with greater clarity. Together, these developments remind us that while headlines can shake investor confidence in the short term, long-term success depends on staying focused, diversified, and informed.

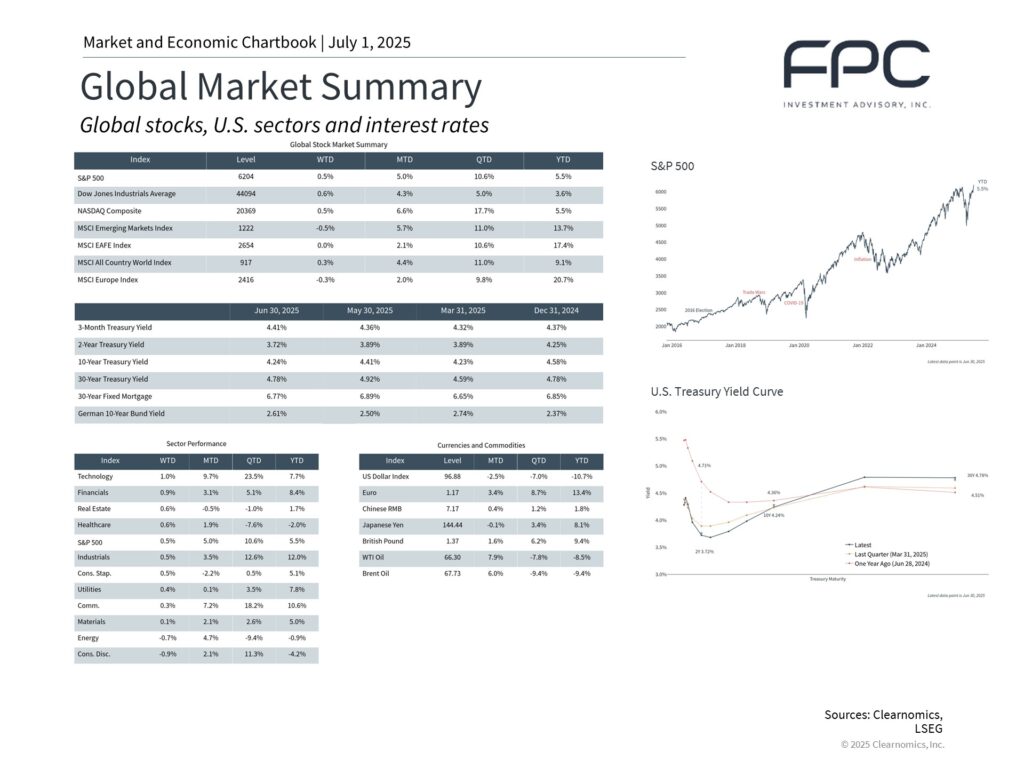

Quarterly Performance Highlights:

- S&P 500: +10.6%

- Nasdaq Composite: +17.7%

- Dow Jones: +5.0%

- MSCI EAFE (International Developed): +10.6%

- MSCI EM (Emerging Markets): +11.0%

The rally was driven by renewed strength in technology and industrials, while small-cap stocks lagged, likely due to their greater exposure to domestic economic conditions and sensitivity to tariffs. Bonds also posted gains, offering ballast as credit spreads narrowed and yields settled.Other notable economic and market developments:

- The Bloomberg U.S. Aggregate Bond Index returned 1.2% for the quarter.

- Gold reached $3,431/oz before settling at $3,308.

- The U.S. Dollar Index fell from 108.49 to 96.88, helping boost international stock performance.

- Consumer Price Index (CPI) rose 2.4% year-over-year, with core inflation at 2.8%.

- The University of Michigan Consumer Sentiment Index improved to 60.7, the first increase in six months.

- The Federal Reserve left its target range for the federal funds rate unchanged at 4.25% to 4.5%. While inflation remains above the Fed’s long-term target, the pace of price increases has slowed. The Fed projects 2025 GDP growth at 1.4% and expects inflation to fall to 2.1% by 2027.

What the “One Big Beautiful Bill” Means for Investors

After months of negotiations, a new tax and spending bill was approved by Congress and signed into law by President Trump on July 4th. This new budget is far-reaching, encompassing numerous provisions, including making many parts of the Tax Cuts and Jobs Act permanent, increasing state and local tax deductions, extending the estate tax limits, and more.

While trade policy has been at the forefront over the past several months, tax and spending policy in Washington has been a growing source of uncertainty for many years. While there is political disagreement with the direction of this new budget, it does eliminate the possibility of a “tax cliff” – a situation where tax policy could have changed dramatically if provisions expired at the end of this year.

On an individual level, taxes directly affect many aspects of financial planning, and the specific provisions in this tax bill have immediate implications for household finances. From an economic perspective, many investors also worry about the level of government spending, the growing national debt, and other factors that have weighed on markets over the past two decades.

Thus, there are many angles from which to view the recently passed budget. What do investors need to know when it comes to their financial plans and what it means for markets in the years to come?

The Tax Cuts and Jobs Act Rates Are Now Permanent

The new tax bill, dubbed the “One Big Beautiful Bill” by the administration, extends and expands several key aspects from the 2017 Tax Cuts and Jobs Act (TCJA) that were set to expire this year. Here are some of the major provisions:

- Current TCJA tax rates and brackets are now permanent. They were initially set to expire at the end of 2025.

- The standard deduction increases to $15,750 for single filers and $31,500 for joint filers in 2025.

- An additional $6,000 deduction (“no tax on Social Security”/”Senior Bonus”) is available for each taxpayer age 65 or older. It applies to single filers with income up to $75,000 and joint filers with income up to $150,000, with a phaseout above those limits. This provision is in addition to the standard deduction and the existing senior add-on, and is set to expire in 2028.

- The alternative minimum tax exemption is now permanent. It also increases phaseout thresholds to $500,000 for single filers, which will be indexed for inflation in the future.

- The child tax credit rises from $2,000 to $2,200 per child, with future adjustments indexed to inflation.

- The state and local tax (SALT) deduction cap increases to $40,000 from a $10,000 limit with annual increases of 1% through 2029. It is then scheduled to revert back to $10,000 in 2030. It is important to note that the higher cap begins to phase out as income exceeds $500,000 (for single or married individuals).

- A deduction for tip income capped at $25,000 annually for workers earning less than $150,000, effective through 2028. The Treasury Department will determine and publish the eligibility criteria.

- Some energy tax credits are repealed, including those for electric vehicles (expires September 30th 2025) and the residential energy credit (expires December 31st 2025).

- The federal debt limit increases by $5 trillion. This will prevent Congress from having to debate and approve debt limit increases for some time, reducing political uncertainty.

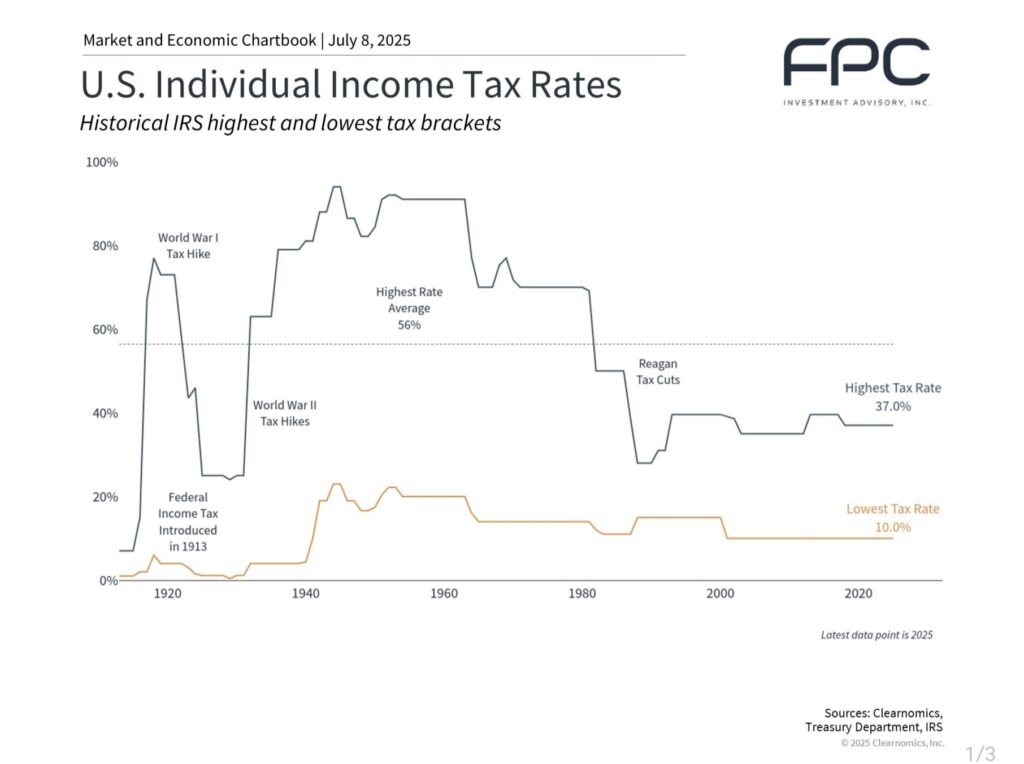

These and many other changes maintain the relatively low tax environment that has characterized the past several decades. As the accompanying chart shows, current tax rates remain well below the peaks experienced during much of the 20th century, when top marginal rates exceeded 70% and sometimes reached above 90% during wartime periods.

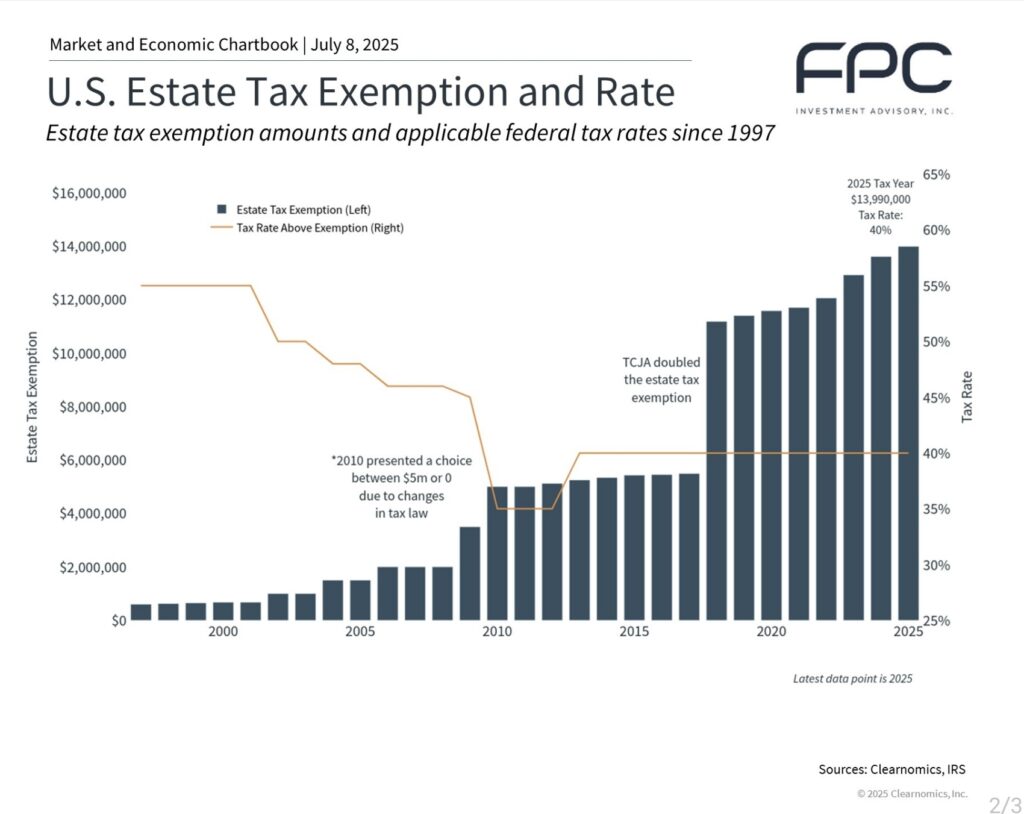

The Bill Continues The Higher Estate Tax Exemption Limit

One set of provisions that would have been at the center of a tax cliff is the estate tax exemption. The TCJA doubled these limits, which were scheduled to revert to previous levels this year. However, the passage of the new tax bill makes these higher exemptions permanent, further increasing the threshold to $15 million for individuals and $30 million for couples in 2026.

While it may seem that estate taxes only apply to higher-net-worth households, the reality is that all families must consider how assets can be passed on to future generations. This requires a holistic approach that integrates estate planning, tax efficiency, philanthropy, and long-term family wealth preservation goals. It’s also important to keep in mind that individual states can also impose estate taxes with exemption thresholds that are less favorable than the federal level.

Growing Concerns Over Fiscal Deficits

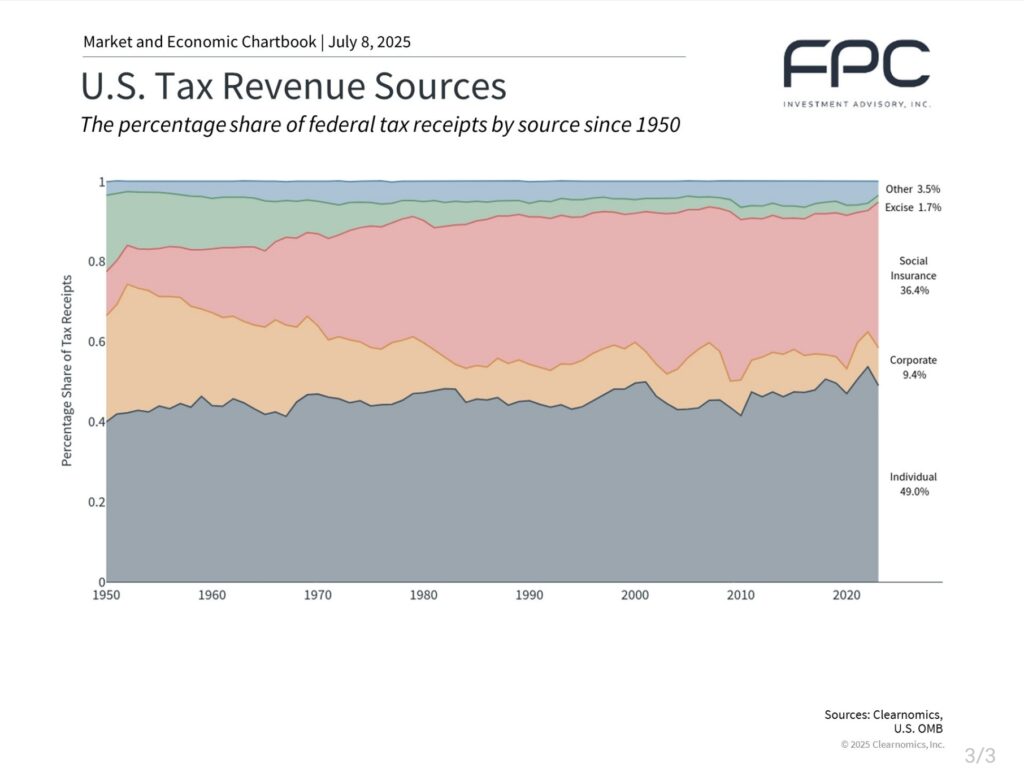

Tax policy and government deficits are inherently connected. Cutting taxes reduces federal revenue, often necessitating either spending cuts or increased borrowing to offset the shortfall. Yet, the bulk of federal spending—on Social Security, Medicare, defense, and interest payments—is politically difficult to reduce. As of 2025, these four categories make up over 60% of government expenditures.

Given these constraints, rising deficits have become a long-term trend. The Congressional Budget Office estimates that the recently passed tax and spending bill will add $3.4 trillion to the national debt over the next decade. This is in addition to an existing debt load that exceeds 120% of GDP—more than $36 trillion, or roughly $106,000 per American.

Although tax cuts may boost economic activity, they rarely lead to balanced budgets. The last U.S. budget surplus occurred during the Clinton administration, more than 25 years ago. Historically, the modern income tax system began in 1913 and expanded significantly during the Great Depression and World War II, with top rates reaching a peak of 94%. Later reforms, such as the 1986 Tax Reform Act, simplified the code and lowered rates, but debates over tax structure persist.

Today, individual income taxes are the government’s largest revenue source, as shown in the chart. Payroll taxes follow, supporting programs like Social Security and Medicare. Corporate taxes and excise taxes contribute far less.

Final Thoughts

The second quarter of 2025 reaffirmed the value of discipline and diversification. Markets demonstrated resilience, quickly rebounding to record highs despite early volatility and global tensions, while recent tax legislation has reduced policy uncertainty and provided clarity for investors. Yet fiscal challenges such as rising national debt and deficits remain significant long-term considerations. Investors should continue to focus on balanced portfolios designed to perform across various economic environments, keeping their long-term objectives clearly in sight.

The FPC Team