Get to Know Us

Our 3-Step Discovery Process

Whenever meeting prospective clients, our goal is never to approach the conversation with a sales mindset. We believe that getting to know one another is the most important thing we can do. Our process is designed so that we truly get to know you – as such, the entire process is at no cost or obligation.

STEP One

Discovery Meeting

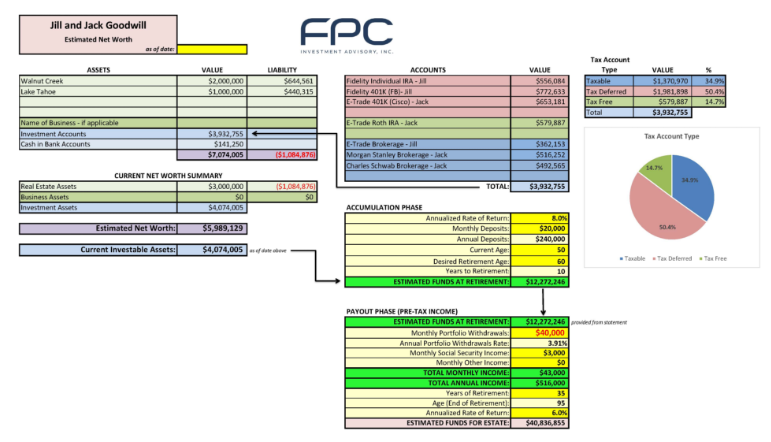

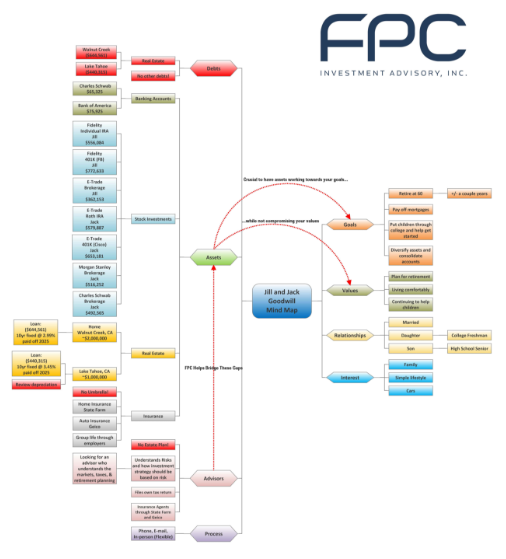

In our initial discovery meeting, we focus on getting to know a lot about you. This includes gathering your personal information as well as collecting your financial data. Together, we will review your goals, values, and financial objectives.

STEP Two

Investment Proposal

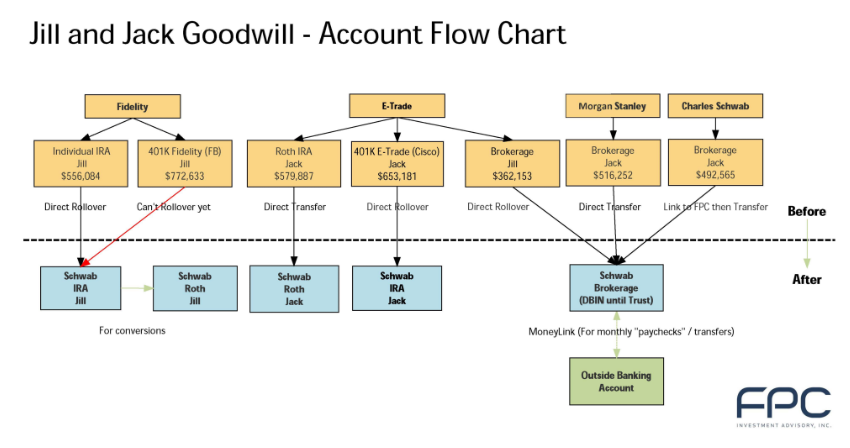

We share a presentation about how FPC operates as a firm and review a prepared Mind Map – a comprehensive outline of your financial situation with specific recommendations. We'll also present an Investment Proposal which outlines what it’s like to work together.

STEP Three

Mutual Commitment

We always want our clients to feel comfortable and confident in working with us. We allow you as much time as you need to review the materials and ask any questions you may have to determine if FPC is a good fit.

Frequently Asked Questions

Expertise, experience and trust.

Financial success is about investing, but also much more. At FPC, we are experts in everything from investments to financial planning to tax optimization. And we work with some of the very best lawyers and accountants to address our clients’ most complex challenges and opportunities.

At FPC, we believe we have a track record that few advisory firms can match. More than three decades, we’ve guided our clients through all kinds of market and economic conditions—and we’ve helped them remain confident in pursuing their goals.

We take our clients’ trust very seriously. We have aligned our ideals and our business model to provide service that put your interests first, with absolutely no exceptions.

There are two standards of client care within the financial advisor world. One, known as the “suitability” standard, requires that advisors’ recommendations merely be “suitable” to clients’ needs. At FPC, we believe that the suitability standard leaves too much room for conflict of interest.

We adhere to the far more stringent “fiduciary standard.” As fiduciaries, we are required to act in your best interest by placing your interests ahead of our own and providing objective advice and guidance in all situations.

There are two typical ways that advisors are paid. “Commission-based” advisors collect a sales charge every time you buy an investment or other financial product that they recommend. We believe that creates a temptation for advisors to sell you more products, more often—and also to steer you toward those that pay them the highest commissions.

At FPC, we provide different fee structures depending on the type of service. For clients who engage us for specific projects or consultations, we may charge an hourly fee that is clearly stated up front. For clients who retain us for ongoing investment management, we typically charge a fee based on a percentage of the assets we manage on their behalf. These distinct models ensure transparency and alignment, so that you always understand how our compensation works for the service you are receiving.

At FPC, our fee model is designed to be fair and straightforward. We never charge sales commissions; instead, we charge an ongoing fixed fee that is based on the asset total we manage for each client. We strongly believe that this approach fits our mission of always putting our clients’ interests first. View our tiered fee schedule →

Generally we require that you maintain a minimum of $1,000,000 in assets under management. However, at our sole discretion, we will reduce the asset level based upon certain criteria (i.e. anticipated future earning capacity, anticipated future additional assets, dollar amount of assets to be managed, the amount of time necessary to manage the assets, related account values, account composition, negotiations with client, etc.)

When choosing investments, we consider not only their quality but also their overall cost. Keeping transaction costs low can help clients retain more of their investment returns over time. Accordingly, we often recommend mutual funds or exchange-traded funds that have low or no transaction fees.

Just provide us with a copy of a current statement from that advisor. We’ll take care of setting up a new account and having your asset transferred.

Taxes are typically one of the largest bills that families and individuals pay each year. Minimizing the amount you owe, not just this year but over the long term, can make a big difference as you work toward your financial goals. So tax guidance is valuable—and because we are licensed tax practitioners, we can provide a level of guidance that other advisors cannot.

Two Convenient Offices

Mailing Address:

P.O. Box 750129

Petaluma, CA 94975

Office: (707) 795-0500

Toll Free: (800) 408-4683

Fax: (707) 703-4414

Have Questions?

We’re here to support you! Please reach out to us with any questions.

By entering your information, you consent to FPC Investment Advisory contacting you and acknowledge that you are electing to opt in to our privacy policy. Submitting your information does not establish a client-adviser relationship with FPC.