2025 Year in Review – A Historic Market Year for Investors

2025 was a historically strong year for markets despite the many events that took place along the way. The past year delivered no shortage of headlines including April’s tariff announcements, ongoing developments in artificial intelligence stocks, the passage of the One Big Beautiful Bill Act, and more. Yet through it all, investors are likely happy as U.S. stocks rose to new record highs, international markets outperformed, and bonds continued their rebound.

The past year reinforces the lesson that the best way to weather uncertainty is to remain disciplined and focused on long-term goals. As we look ahead to 2026, understanding what drove markets last year can help investors navigate the challenges and opportunities that lie ahead.

Key Market and Economic Drivers in 2025

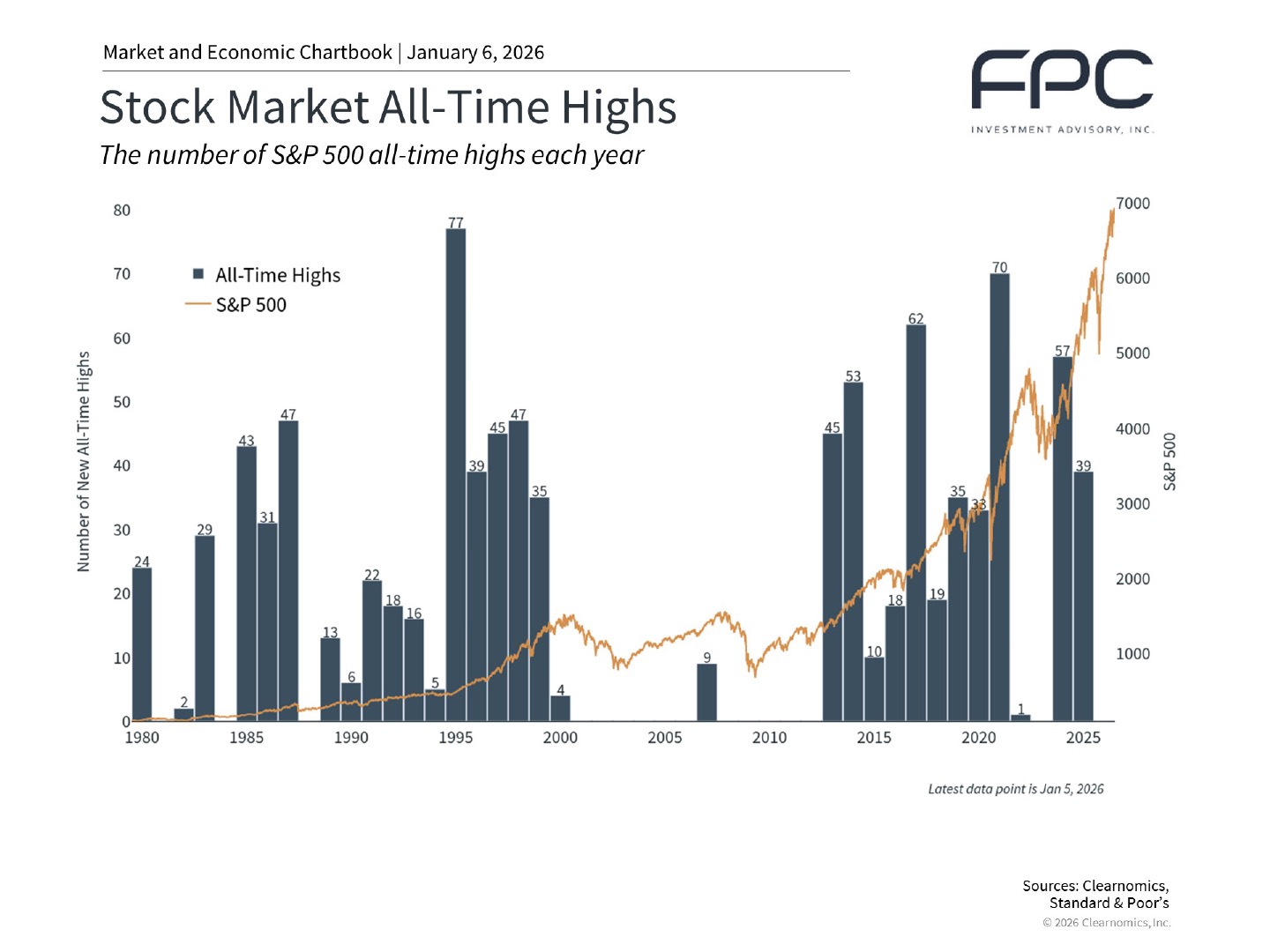

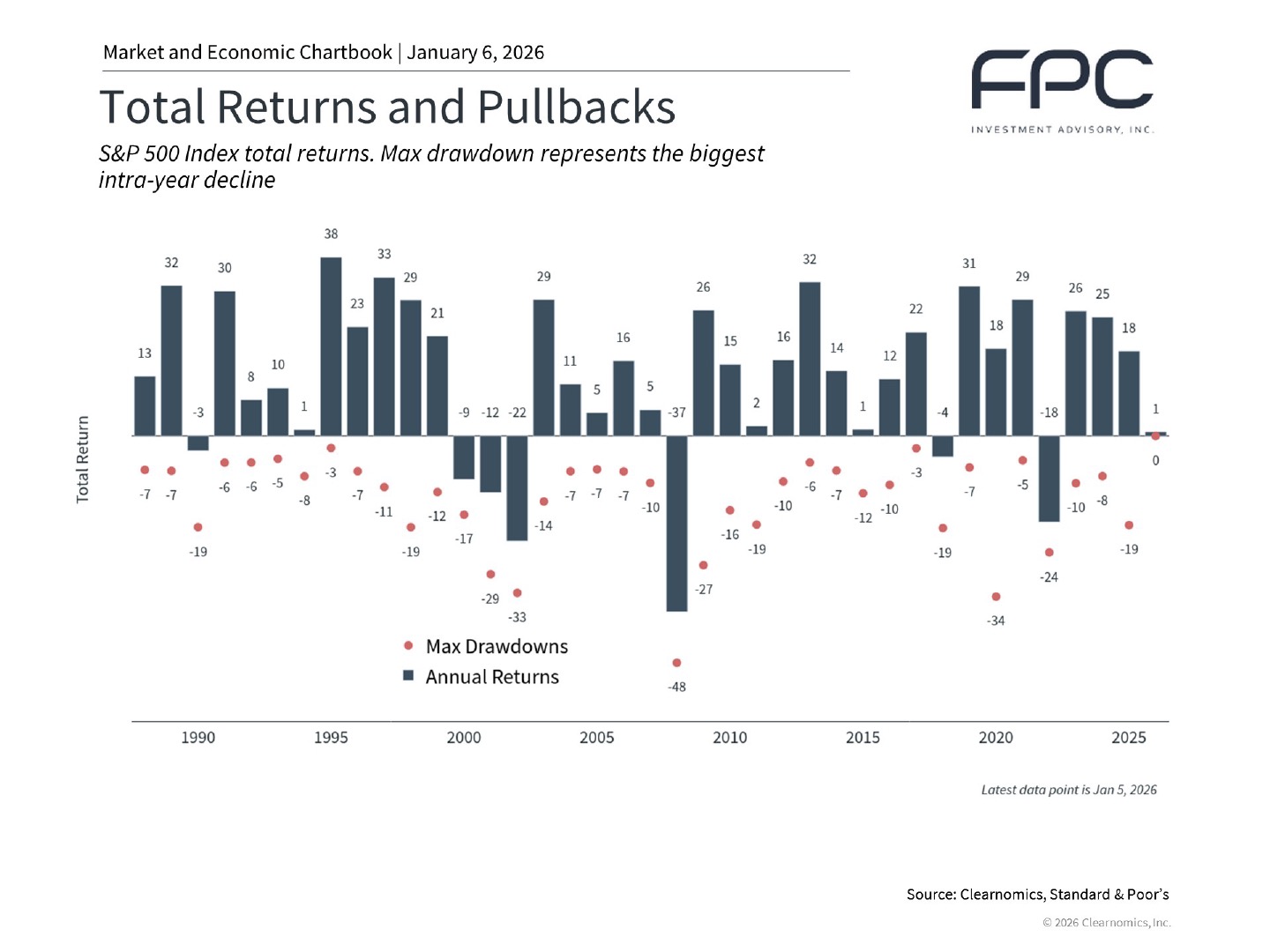

- The S&P 500 gained 16.4% in 2025, achieving 39 new all-time highs. The Dow Jones Industrial Average rose 13.0% and the Nasdaq returned 20.4%.

- The VIX, a measure of stock market volatility, remains low by historical standards, finishing at 14.95 after climbing as high as 52.33 in April.

- The Bloomberg U.S. Aggregate Bond Index gained 7.3%, its best performance since 2020. The 10-year Treasury yield ended the year lower at 4.18%, down from 4.58% at the start of the year.

- International developed markets and emerging markets each gained over 30% in U.S. dollar terms based on the MSCI EAFE Index and MSCI EM Index, respectively.

- The U.S. dollar index ended the year at 98.32, falling 9.3% from 108.49 at the beginning of the year. The dollar reached a low of 96.63 in September.

- Gold prices rallied throughout the year, finishing at $4,341 per ounce for a 64% gain. Silver prices also rose to $70.60 per ounce from $29.24 at the start of the year.

Major Events in 2025

Many of the events of the past year were “known unknowns.” This concept was made famous by former Secretary of Defense Donald Rumsfeld, who distinguished “known unknowns” from “unknown unknowns.” For investors, this distinction can be helpful since the former are uncertainties we can anticipate. When markets react to these events, investors can be prepared in advance and avoid being caught off guard.

Concerns around tariffs, for instance, were very much on investors’ radars ahead of April 2. While this didn’t diminish the market reaction due to the size of these tariffs, it did allow the market to rebound quickly once events played out. Investors also knew the Fed would likely adjust rates once the job market weakened. Many also expected a new tax bill to pass given that Republicans control both houses of Congress.

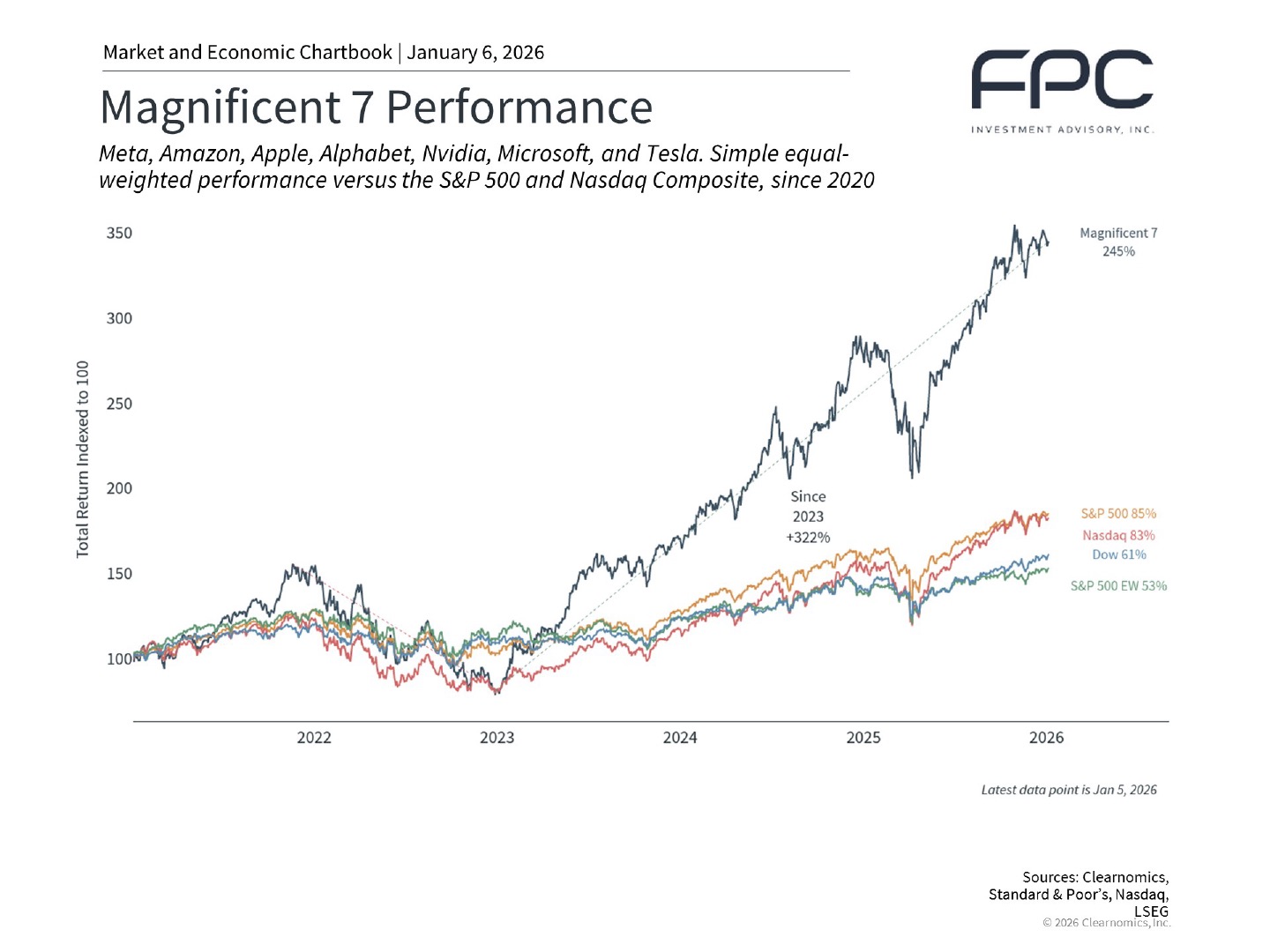

Even concerns around AI, which are perhaps the biggest uncertainty for markets today, have also been at the top of investors’ minds. While the DeepSeek moment in January, when a Chinese AI company showed that models could be created and run more cheaply, was unexpected, the parallels to the dot-com boom and past surges in capital expenditures by large companies are well understood.

To summarize the major market-moving events over the year, here are the top 10:

- January 20: President Trump is inaugurated.

- January 21: The $500 billion private-sector Stargate project is announced.

- January 27: AI stocks fall on DeepSeek news.

- April 2 to 9: “Liberation Day” tariff announcement leads to a market correction. This was followed by a 90-day pause which sparked a rally.

- July 4: The “One Big Beautiful Bill Act” is signed into law, extending many Tax Cuts and Jobs Act provisions.

- September 17: The Fed begins cutting interest rates again.

- September 22: Nvidia and OpenAI announced a major strategic partnership and investment, raising concerns of “circular deals.”

- October 1: The government shuts down for what would be a record-setting 43 days.

- October 14: Jamie Dimon warns of “cockroaches” after the bankruptcies of Tricolor and First Brands.

- December 16: According to the BEA, the unemployment rate hit a four-year high of 4.6% in November.

Three Key Themes Defined the Past Year

What themes drove markets across these events? First, it’s hard to miss the fact that artificial intelligence dominated market narratives throughout 2025. From massive infrastructure investments to concerns about market concentration, AI grew as an important source of economic growth and market returns. The Magnificent 7 stocks now represent around one-third of the S&P 500, creating concentration risk that means most investors have exposure to these stocks whether they realize it or not. Recognizing this when crafting investment strategies and financial plans will only grow in importance.

Second, tariff policy created uncertainty but has had less economic impact than expected. Tariffs on imported goods have risen sharply for many trading partners, yet the feared economic consequences largely failed to materialize. This is because companies adapted, tariffs were paused or scaled back, and consumer spending remained strong. For investors, this highlights that the outcomes of policy changes in Washington, whether its trade or federal finances, do not always have an obvious effect on the economy or markets.

Third, many asset classes performed well in 2025. International stocks outperformed U.S. markets, due in part to the decline in the U.S. dollar. Bonds generated strong returns and have nearly recovered their losses from 2022. Other individual assets including gold also had record years. So, benefiting from all of these asset classes is less about making individual investments, but about having the right asset allocation that can take advantage of opportunities while managing sources of risk.

What 2025 Reinforced About Long-Term Investing

2025 was a strong year for markets, but its most important takeaway was not about reacting to headlines or predicting outcomes. It reinforced that disciplined asset allocation works, even when it feels uncomfortable in the moment. Investors who maintained balanced allocations participated in multiple sources of return, while those who concentrated portfolios around what had worked most recently often lagged broader opportunities.

That is the purpose of diversification. It is not designed to maximize returns in any single year. It is designed to reduce the risk of permanent damage over time while allowing portfolios to participate when leadership changes. 2025 was a clear example of how that discipline pays off.

Well-constructed portfolios balance growth and resilience. Too much risk increases vulnerability during drawdowns. Too little risk allows inflation to quietly erode purchasing power. The most durable portfolios live in the middle ground, and that balance was rewarded this past year.

Cash and bonds also played their intended roles. Liquidity and income provided stability, flexibility, and the ability to rebalance without being forced to sell long-term assets during periods of stress. This supports better decision-making when markets are volatile.

The lesson of 2025 is not that strong returns are guaranteed going forward. It is that asset allocation and diversification continue to do what they are supposed to do. When investors stay disciplined, avoid overreacting, and allow the portfolio structure to work, favorable outcomes tend to follow.

The bottom line? 2025 was a strong year for investors. While we celebrate a good year in markets, it underscores the importance of maintaining investment discipline. Investors should continue to apply this lesson to their investment and financial plans for the coming year.