From 2021 to 2022, the global economic and market conditions have two very different stories to tell. Headwinds started to prevail in the latter part of 2021. In the fourth quarter, the U.S. economy enjoyed an increased Gross Domestic Product (GDP) of 6.9%. Inflation (expected to be transitory) was becoming more of an issue with consumers’ increased demand causing supply-chain shortages. Consumers and businesses were flush with cash from increased savings. By the end of 2021, consumers were enjoying record net-worth from rising stock and real estate prices.

We are now past the mid-point of 2022, and much has changed in the last six months. COVID-19 continues to be a global problem with more transmissible variants. Inflation is a significant global problem as demand for goods increases dramatically. The Fed and other central banks have begun to raise interest rates to combat inflation. The Russia-Ukraine conflict began on February 20th as Russia invaded Ukraine, further exacerbating problems with supply-chain issues and commodity prices. With all the above, the stock and bond markets of the world have declined over the first two quarters of 2022 as growth has slowed.

Below you will find some key points on our current economic landscape.

The U.S. & Global Economies:

- U.S. Leading Economic Index (LEI) decreased by -0.8% in June, following a -0.6% decrease in May. The Coincident Economic Index (CEI) was up 0.2% in June, following a 0.2% increase in May. The Lagging Economic Index (LAG) increased 0.8% in June after a 0.8% increase in May. With the Leading indicator moving down and the Coincident and Lagging indicators moving up, it would suggest the U.S. economy is slowing but not at a recessionary level.

- U.S. nonfarm payrolls rose 528,000 for July, which was better than anticipated. The unemployment rate in the U.S. was 3.5%, down slightly from the prior three months’ rate of 3.6%. The IMF (International Monetary Fund) forecasts the U.S. unemployment rate to trend higher over the next few years to approximately 4.0%.

- The U.S. economy ended 2021 with a robust 5.7% GDP annual growth rate. For 2022, GDP has fallen at a -1.6% rate in the first quarter and was off -0.9% in the second quarter. The main drag on the economy was due to increased inventories and a reduction in business spending. On a positive note, net trade (exports vs. imports) made positive contributions as exports were up a substantive 18% for the first quarter.

- China’s 2022 first quarter GDP was 4.8%. Second quarter GDP slowed to 0.4% in the 2nd quarter. The primary reason for the slowdown has much to do with the Chinese government’s zero-tolerance Covid-19 policies.

- The Euro Area had a GDP growth of 0.7% in the second quarter of 2022, beating expectations of 0.2%. This followed a first-quarter GDP increase of 0.5%. Much of the improvement is due to easing covid restrictions and improved summer tourism.

- Japan’s most recent GDP indicated a slightly negative -0.1% in the first quarter, following a 1.0% gain in the last quarter of 2021. Japan’s GDP has been hovering at breakeven since the beginning of 2021. Japan’s unemployment rate was 2.6% in June and remained unchanged from May. Industrial production hit a record high of 8.9%, significantly higher than the consensus estimates of 3.7%. The increase in industrialization resulted from China easing the curbs on Covid measures.

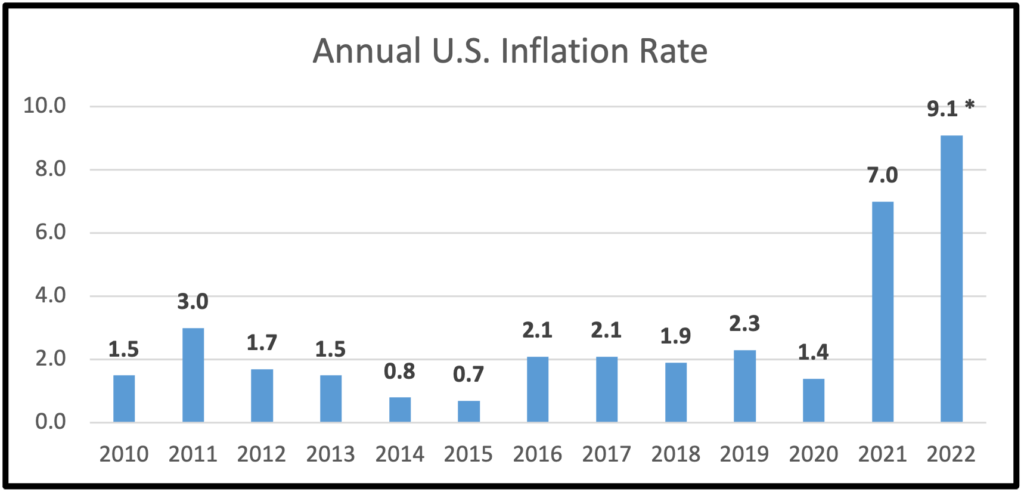

- The U.S. inflation rate has increased 9.1% over the twelve months ending June 2022. (See Annual Inflation Rate Chart below). This is the highest inflation in over 40 years. The most significant increase was in energy prices, which soared over 41%. Other causes for inflation were supply chain issues, food costs, commodities, and increased demand from covid deprived consumers.

Source: Bureau of Labor Statistics

- In July, the Federal Reserve raised its target range for the Fed Funds rate by 0.75% to bring it to 2.25% – 2.5%. This represents the fourth increase and is now at its highest level since 2019. The Fed is committed to reducing inflation and will continue to raise rates until inflation subsides.

- Oil prices peaked in the first quarter just north of $120 a barrel. Since then, oil prices have trended lower and recently traded below $90 a barrel. More recently, oil has been trading lower than at the start of the war in Ukraine.

- The Consumer Confidence Index declined for the third month. The decline was due primarily to consumers’ expectations for decreasing growth and concerns about the rising effects of inflation.

The U.S. & Global Equity and Bond Markets

Equities

- Equities in the second quarter of 2022 pulled back as concerns increased with supply-chain issues, inflation levels, and the Fed increasing interest rates. Large-cap stocks (as measured by the S&P 500 Index) lost -16.1% in the second quarter while showing a loss of -10.6% over the last twelve months (ending June 30th). Across the globe, the developed markets also yielded negative results, with the MSCI All Countries World Index (ACWI) down -15.7% for the second quarter and -15.8% for the last twelve months (ending Jun 30th).

- U.S. small-cap stocks (Russell 2000) fell -25.2% over the last twelve months (ending June 30th) and were down -17.2% in the second quarter of 2022.

- Historical and current consensus estimates for the S&P 500 earnings & price-to-earnings ratios (P/E):

- 2019 actual earnings $162.97: P/E 19.8 (S&P 500 year-end value at 3,230.78)

- 2020 actual earnings $139.76: P/E 26.9 (S&P 500 year-end value at 3,756.07)

- 2021 actual earnings $208.53: P/E 22.9 (S&P 500 year-end value at 4,766.18)

- 2022 future earnings estimate $227.01: P/E 18.3 (S&P 500 current value 4,143.70)

- 2023 future earnings estimate $246.33: P/E 16.8 (S&P 500 current value 4,143.70)

- European stocks (MSCI Europe) were off -17.6% over the last twelve months (ending June 30th) and fell -14.5% in the second quarter.

- Japanese stocks (MSCI Japan Index) were down -14.6% for the second quarter and -19.6% for the last twelve months (ending June 30th). The Japanese economy continues to tread water. Further issues in Japan include a resurgence of COVID-19, prolonged supply-chain problems, and concerns about returning to a deflationary economy. The ten-year Japanese bond only yields 0.186% as the Bank of Japan endeavors to get the economy above “stall speed.”

- China (MSCI China Index) had negative results with a -31.7% loss for the year (ending Jun 30th). For the second quarter, the index was up 3.5% as some indications of relaxing COVID restrictions.

- Technology (MSCI World Information Technology) stocks fell dramatically over the last year (ending June 30th) with a decline of -19.3%. The index declined -21.8% in the second quarter.

- Precious Metals (MSCI ACWI IMI Precious Metals and Minerals Index) declined -34.5% over the last twelve months (ending June 30th).

- Energy stocks (MSCI USA Energy Index) enjoyed a 36.9% return over the last twelve months (ending June 30th). Notwithstanding, they were off -5.7% for the second quarter. Commodities and energy stocks made dramatic increases from the 2020 pandemic lows due to supply-chain problems and demand issues.

Bonds & Cash

- Short-term Interest rates began to move higher in the first quarter as the Fed raised rates. Short-term bonds (ICE U.S. Treasury Short Bond Index) were mostly breakeven with a small -0.1% return for the last twelve months (ending June 30th). (See Treasury Interest Rates chart below)

- Longer-term bonds (ICE U.S. Treasury 20+year Bond) declined dramatically as the Fed raised interest rates in 2022. The index was off -18.6% over the last twelve months (ending June 30th) and dropped significantly by -12.1% in the second quarter.

FPC Team’s Insights & Perspective:

In response to the COVID-19 pandemic, Congress passed stimulus bills that unleashed the most significant federal monetary subsidy the U.S. economy ever recorded. The amount of this stimulus totaled roughly $5 trillion and was in the form of direct payments to people and businesses. The good news: it was credited with keeping the government-created recession (to stave off the pandemic with lockdowns) to only two months. The stimulus was also the driving force for the stock market gains from the lows of March 2020.

A side effect of the stimulus is an excess of money supply that is now causing significant inflation, the likes of which we have not seen for 40 years. The Fed is now tasked with following its mandate to return the economy to sustainable price levels by increasing interest rates.

The Fed’s first rate increase was 0.25% in March, lifting it from an effective 0.0% level. Since then, the Fed has moved forcefully to raise rates to a new range of 2.25% to 2.5% and is on track to raise rates by at least 50 basis points in September. The target for the Fed Funds Rate is between 3.25% to 3.50% by the end of 2022.

FPC’s Outlook

At this juncture, we find ourselves with several mixed indicators, both bullish and bearish. The Fed is raising rates to reduce inflation, but they want a “soft-landing” with no recession. Inflation has been high, but prices now appear to be declining as food, commodities, and energy prices continue to drop. Leading economic indicators are NOT forecasting an imminent recession; instead, the indicators are pointing to slower GDP growth. The yield curve (an indicator of future economic activity) is giving conflicting signs of future growth in the economy. The Consumer Confidence Indicator has fallen for three months; paradoxically, consumers are still flush with cash, and employment prospects are excellent.

Businesses and consumers are challenged on how best to cope in this complex environment. The stimulus during the pandemic, both fiscal and monetary, is the primary cause of current inflation levels. Global growth is slowing but not yet contracting. The central banks are now faced with a balancing act of reducing inflation without causing a recession.

As we look forward, the various economic indicators are showing mixed messages. We believe that in this environment, it is appropriate that we maintain our current balanced allocations awaiting further clarity.

The U.S. remains somewhere between waypoints 3 and 4; while there is still ongoing growth, inflation is now a cause of concern. More importantly, the Fed is taking proactive measures to reduce it to more benign levels. (See the Economic Cycle chart below)

The Economic Cycle

We greatly appreciate the confidence you have shown in our services. Thank you for your business!

Sincerely,

Blair McCarthy, Tyler Schalch, CFP® & Bijan Golkar, CFP®