It has now been more than a year since the coronavirus pandemic began in earnest around the globe. Worldwide, economies were shut down as businesses were closed to prevent the further spread of the virus. Since then, the world has showed a remarkable resurgence in growth, reflecting the global perception that an effective vaccine has been developed.

The turnaround has much to do with getting a handle on the pandemic, and that started with the distribution of vaccines. Since the initial shots were implemented in mid-December 2020, 44% of the U.S. population has received at least one shot and 31% are now fully vaccinated.

Much of our work is tailored around evaluating the current economic climate, and in this way, we adjust our investment strategies moving forward. The pandemic has created some new economic issues and solutions, and as such, we are reviewing a wider range of aspects of the global economies. We have listed key bullet-points below to paint the picture of the current economic environment.

The U.S. & Global Economies:

- The global economies and their corresponding markets of the world have done a major turnaround since the lows of late March 2020. This improvement is due to the perception that the future impact of the pandemic will be minimized, and that global growth will resume.

- U.S. Leading Economic Index (LEI) increased 1.3% in March following a 0.1% decrease in February. The Coincident Economic Index (CEI) increased 0.6% following a 0.1% decrease in February and a 0.5% increase in January. Lagging Economic Index (LAG) decreased 0.5% in March after a 1.6% increase in February and a 2.7% decrease in January. The continuing increase in all the economic indicators suggest further improvement of growth in the U.S. economy, and the U.S. is clearly in the recovery stage.

- GDP (Gross Domestic Product) is expected to show a significant turnaround. The following are some expected GDP growth number for 2021:

- China 8.4%

- Japan 3.3%

- Euro Area 4.4%

- United States 6.4%

- Advanced Economies 5.1%

- China had its strongest quarterly growth on record as it continued to have a robust recovery from the coronavirus pandemic. China had GDP growth of 18.3% year-on-year basis in the first quarter, the strongest increase since they began keeping records in 1992.

- As with other countries around the globe, the Euro zone had a dramatic decline in GDP in the second quarter of 2020 (GDP off 11.7%) and had an equally remarkable turnaround in the third quarter (GDP rose 12.5%). Since then, the Eurozone has had slight declines in GDP with the 4th quarter down 0.7% and in the 1st quarter of 2021 GDP was off 0.6%.

- Since mid-March 2020 at the onset of the pandemic, the Fed has effectively reduced rates to zero (0.00% – 0.25%). Based on continuing statements from the Fed, there is little expectation of any increases for several years.

- Global inflation is expected to remain low for the next several years. Inflation in the U.S is currently at 2.3% and is expected to remain in a range from 2% to 3% over the next few years. Global inflation rates are low with the advanced economies at 1.6% and are expected to remain low over the next several years.

- The U.S. unemployment rate was only 3.6% in February 2020. Within the period of two months, the rate skyrocketed to a high of 14.8% in April 2020 as businesses were shut down due to the Covid-19 mandated closures. Since that time, unemployment has declined steadily as businesses adapted, and as a result, the unemployment rate is now at 6.0% (as of March 2021). Worker filings for unemployment benefits in the U.S. reached a new low since the Covid-19 pandemic began. Expectations are for unemployment rates to decline to roughly 4% over the next several years.

- Oil prices (WTI –West Texas Intermediate) had fallen in early 2020 to a low of around $12 a barrel. Since then, oil prices have rebounded dramatically to a current price of $64.85 per barrel with expectations of further recovery as concerns of the pandemic subside.

- Consumer confidence continues to improve and now stands at the highest level since February 2020 which was just prior to the “shelter at home mandates”. As the consumer makes up 68.2% of GDP growth, the increase in Consumer confidence bodes well for continued resurgence as concerns over the pandemic abate in the U.S. economy.

- In a further indication of the economy strength, consumer demand has driven US imports to a record high in March. Imports rose 6.3% for the month of March due to the pent-up demand of consumers. The increased demand is the consumer response to the Fed induced low interest rates as well as the several rounds of fiscal stimulus checks sent out to most Americans.

- President Biden, in an effort to further stimulate the U.S. economy, proposed and Congress approved a $1.9 Trillion fiscal stimulus package called the “American Rescue Plan” in March 2021. It provided direct payment to Americans, extended jobless benefits, funds to cover the cost of distributing the Coronavirus vaccine, aid to state and local governments, as well as funds for businesses that have been struggling during the pandemic.

The U.S. & Global Stock and Bond Markets

Equities

- Large-Cap U.S. stocks did very well over the last twelve months as the economy reacted to the Fed’s low interest rates and Congress’s legislation injecting stimulus into the economy. Large-Cap stocks did well with the S&P 500 moving up 56.4% year-over-year since the end of the first quarter in 2020.

- The historical and current consensus estimates for the S&P 500 earnings & P/E ratios:

- 2019 actual earnings $162.97: P/E 19.8 (S&P 500 year-end value at 3,230.78)

- 2020 actual earnings $139.76: P/E 26.9 (S&P 500 year-end value at 3,756.07)

- 2021 future earnings estimate $184.85: P/E 22.6 (S&P 500 current value 4,178.18)

- 2022 future earnings estimate $207.93: P/E 20.1 (S&P 500 current value 4,178.18)

- U.S. small cap stocks (Russell 2000) soared with a 94.9% return over the last twelve months (ending March 31st).

- With the earnings season more than halfway over, most companies in the S&P 500 have surpassed analysts’ profit expectations. The latest data indicates that 87% of companies were reporting better than analyst’s expectations. Earning projections are on pace for exceeding the projections by the highest amount ever.

- European stocks (MSCI Europe) were up 43.7% over the last twelve months, ending April 2021, as the European markets recovered from the initial stages of the Coronavirus pandemic.

- China results soared with a 37.2% gain (MSCI China Index). The major gains had much to do with China’s initial handling of the pandemic and a resurgence in their economy.

- Technology (MSCI ACWI Information Technology) stocks turned in a stellar performance with a 60.2% gain over the last year (Apr 1st, 2020 to April 1st, 2021).

- Precious Metals (XAU – Gold Mining Index) turned in stellar performance with a gain of 75.6% over the last twelve months (Apr 1st, 2020 to April 1st, 2021).

- Energy stocks (XOI – Oil & Gas Index) also performed well with a 74.2% return over the last year (Apr 1st, 2020 to April 1st, 2021).

Fixed Income & Cash

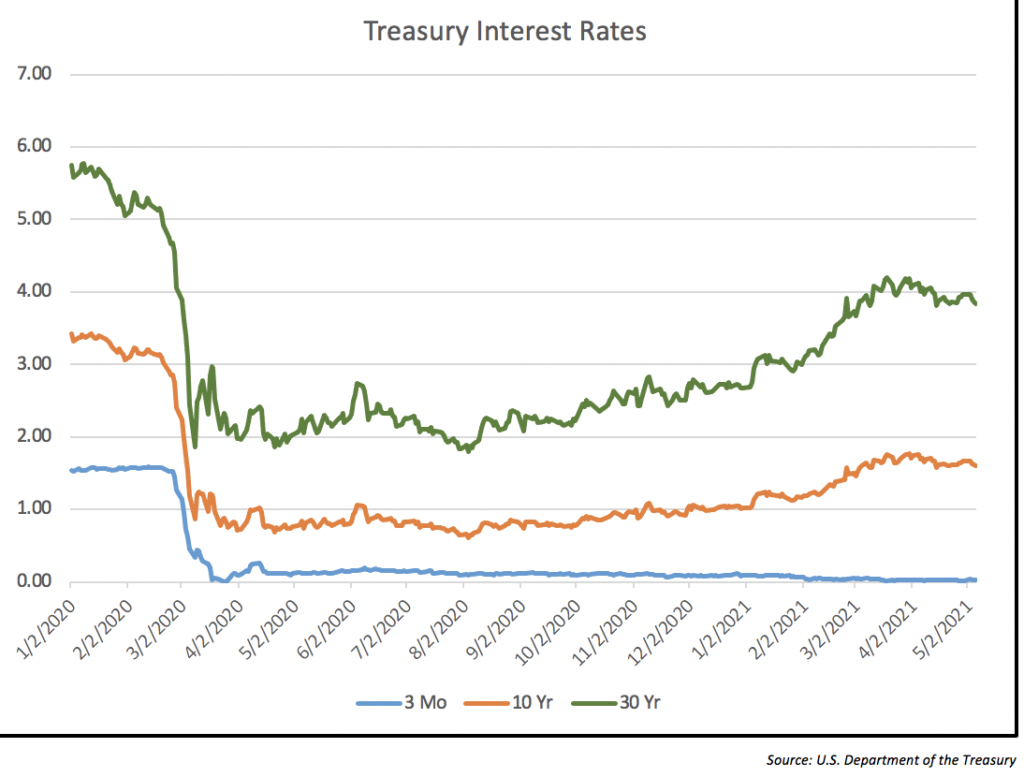

- Short-term Interest rates remained low as the Fed continued to ease since March 2020. Longer term rates also fell initially but have been moving up incrementally over the last year. (See Treasury Interest Rates chart below). The yield curve has been steepening.

- The long bond (S&P U.S. Aggregate Bond) has fallen 2.43% since the beginning of 2021 as long-term interest rates rose.

The FPC Team’s Insights & Perspective:

- With both fiscal and monetary policy on board in the U.S. and throughout the world, equities have the most opportunity of the broader asset categories. Bond yields have been moving higher of recent, while cash yields have lowered to and remain at a zero-percentage rate.

- The global markets are awash of vast amounts of liquidity as the Central banks have lowered interest rates, and governments are providing stimulus to pick up their economies.

The FPC Outlook

So, what is our view of the future? The economies have improved dramatically since the re-openings of businesses, and unemployment has dropped from its previous highs. There is a tremendous (one could say extraordinary) amount of both fiscal and monetary stimulus that has been injected into the economies of the world. The market(s) have seen a dramatic rise from the March 23, 2020 low. Since then, the S&P 500 has jumped over 80%.

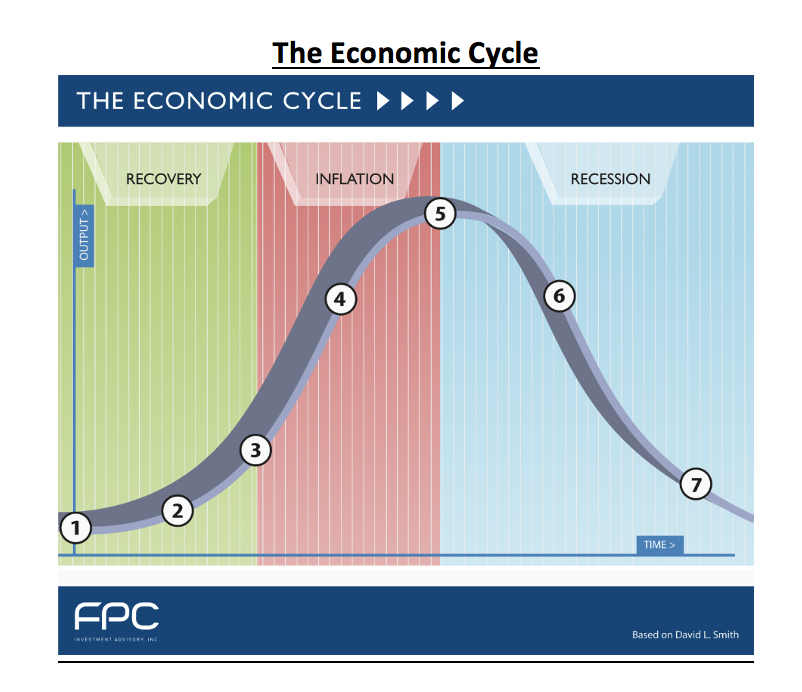

It is our belief that for the near-term future, the key indicator for the global economies will be the overall handling of the COVID-19 pandemic. As people resume their pre-pandemic lives, the economies of the world should see significant improvements. Notwithstanding, there are countries still suffering with a resurgence of the coronavirus and the management of the pandemic will impact their economic recoveries. The global economies are in a recovery phase (between waypoint 2 & 3 below) which bodes well for the stock markets looking forward.

The Economic Cycle

Against that backdrop, domestic market valuations are clearly on the expensive side while international valuations are more attractive. As such, we have shifted some of the U.S. allocations to the Eurozone and Asian asset classes. Ultimately, at this point in the economic cycle, equities are the best opportunity looking forward.

We greatly appreciate the confidence you have shown in our services. Thank you for your business!

Sincerely,

Blair McCarthy & Bijan Golkar, CFP®