With November just around the corner, we are looking back at 2020 and planning for 2021. It’s no secret that the market fluctuations have been unusual this year. With both a global pandemic and a presidential election year, we’ve seen many unprecedented gyrations. Let’s review what we’ve seen in this year’s markets so far, and what investors can do to maintain patience through year-end.

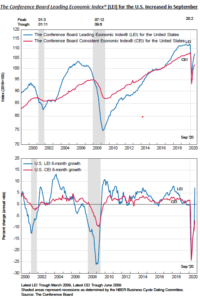

Leading and Coincident Comparisons

When researching markets, the first stop our team makes is reviewing the leading and coincident economic indexes. The leading economic index (LEI) helps to predict and forecast future events and trends in business, market, and the economy. Typically, you can see a leading economic index start to turn down prior to a recession. The coincident index (CEI) is more real-time and helps clarify the current state of the economy. This year, we experienced a sudden drop in both indexes without any forewarning. This was due to the worldwide governmental shutdowns that effectively halted the global economy. However, we can now see that both indexes are starting to steadily recover after our sudden March drop off.

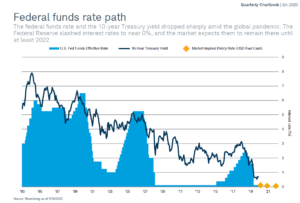

Don’t Fight the Fed

This age-old investing policy says that investors should not go contrary to what the Federal Reserve is doing. For example, if the Fed increases interest rates, that usually indicates a lower stock market ahead. Conversely, when the Fed decreases interest rates, that usually indicates a higher stock market ahead. Many investors try to fight the Fed because increasing and decreasing interest rates make them anxious.

High Cash Levels

Right now, due to monetary and fiscal policy, interest rates have essentially dropped to zero. Notwithstanding, individuals and businesses have been stockpiling cash, earning essentially nothing. Looking to enhance returns, investors will turn back to investing in financial instruments (stocks & bonds) and this tends to be a good sign for future markets.

Yield Curve

A positive yield curve results when the yield on long-term U.S. Treasury bonds is higher than the yield on short-term Treasury bills. We are currently seeing a positive (upward-sloping) yield curve, which can be a bullish indicator for the stock market.

Takeaways

Most of our indicators are indicating that 2021 will likely be a year of resurgence. Of course, if 2020 has taught us anything, it’s that markets can change overnight with no warning depending on a variety of factors (global pandemics included). Anything can happen, however, research is showing that the markets are currently recalibrating. This means that earnings could show a sharp increase in Q4 of 2020, and in Q1 of 2021.

Have questions about our 2020 Q3 Market Recap video? Want to discuss your 2021 strategy? Please do not hesitate to reach out.